2016 State of the Industry

by Jonathan McGaha | 4 January 2016 12:00 am

The new year promises lots of opportunity and many challenges

In 2015, the metal construction industry began to rise steadily and slowly. The November 2015 jobs report from the U.S. Department of Labor showed that much of the employment growth nationwide was being driven by increases in construction activity. Still, we face a less-than-robust economy that has unique challenges in the construction industry. Some markets look to improve more than others, Millennials are emerging as a driving economic force and we face an increasingly dire labor shortage.

We asked a group of industry experts to weigh in on these factors from their individual perspectives. The following pages provide a spread of information on the state of the metal construction industry.

The Industry by the Numbers

The Industry by the Numbers

By Alex Carrick, Chief Economist, CMD

U.S. multifamily housing starts have returned to a level as high as they were before the Great Recession. Single-family starts remain nowhere close to their previous heights. While this indicates gathering pent-up demand in the single-family market, it also reflects a significant change in the way many people want to live. Mixed-use projects, incorporating high-rise living and located at transit sites in city cores, have become much more popular among both an aging population and Millennials. There’s a lot more to like about downtown residences than a generation or so ago, when smog ruled. Now, there are parks and rooftop gardens everywhere. Besides, young and old appreciate the easy access to shopping, entertainment venues, medical services and a myriad of other amenities.

Read More[1]

Mergers Run Rampant in Construction Industry

Mergers Run Rampant in Construction Industry

By Alex Miller, Associate, FMI Capital Advisors

Both global and domestic mergers and acquisitions (M&A) activity across all industries reached an all-time high in 2015, spurred by low interest rates (i.e., cheap debt), a desire to improve efficiencies in a slow recovery, and the need to keep pace with both international and consolidating competitors. The engineering and construction (E&C) industry, specifically, is also consolidating at a rapid pace and is resulting in an altered competitive landscape.

The headlines in 2013 and 2014 were defined by large mega-deals as a number of multibillion dollar transactions led to the creation of even larger industry conglomerates. While 2015 did not see the same fireworks as recent years, deal activity in 2015 is on pace to reach a new record level (see chart this page). Through Dec. 9, 2015, FMI tracked 336 transactions in the E&C industry, including architects, engineers and contractors across all end markets.

[2][3]Read More[4]

The Workforce Dilemma: What To Do?

The Workforce Dilemma: What To Do?

By William Good, CEO , National Roofing Contractors Association

It’s no secret that the U.S. construction industry is facing acute labor shortages in virtually all sectors. There are lots of reasons for this: the country has aged; we lost a lot of workers following the financial crisis of 2008 who never returned; high schools are incentivized to send their graduates to college; and our national immigration policy is, well, a mess.

In my industry-roofing-we know the following to be true, and to further compound the problem:

- The average age of a first-day-on-the-job apprentice roofer is 29.6 years

- 53 percent of our workforce is Latino; the majority of those were born outside the U.S., and language and literacy are significant barriers to training

- Accident and injury rates for our workers rise dramatically at age 45

- Demand for roofing work is projected to increase, on average, by about 5 percent annually in the foreseeable future

[5]Read More[6]

Steel Pricing Difficulties

Steel Pricing Difficulties

By Kathryn Thompson, CEO, Thompson Research Group

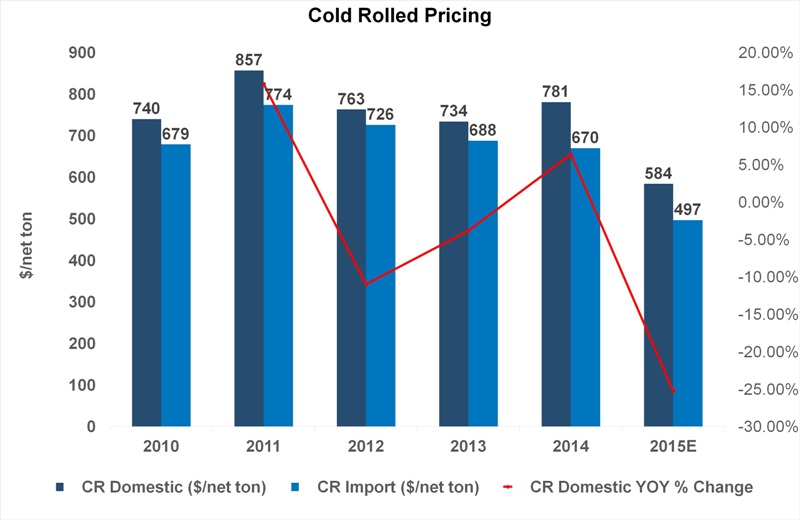

After a brief rebound in 2014, we have experienced a significant drop in steel prices in 2015, which doesn’t appear to be abating going into 2016. Both cold rolled and hot rolled pricing dropped significantly this year. Cold rolled year-over-year pricing is estimated to decline 25 percent for domestic steel and 26 percent for imported steel. The story is even more accentuated on the hot rolled side, with domestic pricing down 31 percent year over year for 2015 and imported pricing declining 31 percent as well.

We don’t see pricing trends improving in the near to midterm. The domestic commercial construction end market demand is good, which likely would drive up prices, but it’s not enough to offset the global macroeconomic issues driving down the pricing. The hard reality is China economic growth is slowing but steel production isn’t being cut fast enough to offset the price drops. The low-priced steel is hitting the market, holding down prices.

[7]Read More[8]

Regulatory Affairs Require Close Monitoring

Regulatory Affairs Require Close Monitoring

By Andy Williams, Director of Codes and Standards, Metal Construction Association

The Metal Construction Association (MCA) continues to be involved with regulatory efforts in North America to address member concerns and issues regarding the use of metal in construction. The primary areas of involvement in 2016 will continue to be sustainability, fire performance and structural performance required to conform with regional and national building codes and standards.

MCA’s sustainability efforts will continue in the area of Environmental Product Declarations (EPD) and Health Product Declarations (HPD). These critical documents provide metrics concerning the performance of wall or roof assemblies, and allow the performance of one assembly to be compared to another assembly. This comparison is often a key deciding factor in the choice of product.

Read More[9]

Marketing for Construction Products and Services Turns a New Corner

Marketing for Construction Products and Services Turns a New Corner

By Neil Brown, Chairman, Construction Marketing Association

The Construction Marketing Association (CMA) surveys members and the overall construction industry each year to identify opportunities and trends. Association members and survey respondents are from construction firms of all types and sizes, and also manufacturers of all types and sizes that serve the construction industry.

Almost all 2015 respondents intend to increase marketing in 2015

(93 percent). The survey categorizes marketing by traditional, Internet and lead generation marketing tactics. Traditional marketing includes branding, advertising, publicity, trade shows and more. Not surprisingly, email is increasing for all respondents, while advertising and direct mail are decreasing (see chart above).

Read More[10]

- Read More: /articles/2016-state-of-the-industry-economic-activity

- : /articles/2016-state-of-the-industry-mergers

- : https://www.metalconstructionnews.com/articles/2016-state-of-the-industry-mergers

- Read More: https://www.metalconstructionnews.com/articles/2016-state-of-the-industry-mergers

- : /articles/2016-state-of-the-industry-labor-shortage

- Read More: https://www.metalconstructionnews.com/articles/2016-state-of-the-industry-labor-shortage

- : /articles/2016-state-of-the-industry-steel-pricing

- Read More: https://www.metalconstructionnews.com/articles/2016-state-of-the-industry-steel-pricing

- Read More: /articles/2016-state-of-the-industry-regulations

- Read More: https://www.metalconstructionnews.com/articles/2016-state-of-the-industry-marketing

Source URL: https://www.metalconstructionnews.com/articles/2016-state-of-the-industry/