40th Annual Contractor Survey

by Paul Deffenbaugh | 1 March 2021 12:00 am

Our annual contractor survey reports a weak market, but maybe not as weak as expected

In many ways, we are in the middle of a similar kind of feeling, although the reason is a depressed economy due to a pandemic and not the Federal Reserve’s attempt to control inflation with high interest rates.

Dodge Data & Analytics predicts that construction starts will increase 4% in 2021 and, in a way, that number is remarkably low. If the last year was as bad as reported, a rebound—even back to normal—would indicate a significantly higher number. There’s a reason for that. The last year was, surprisingly, not as bad as we thought.

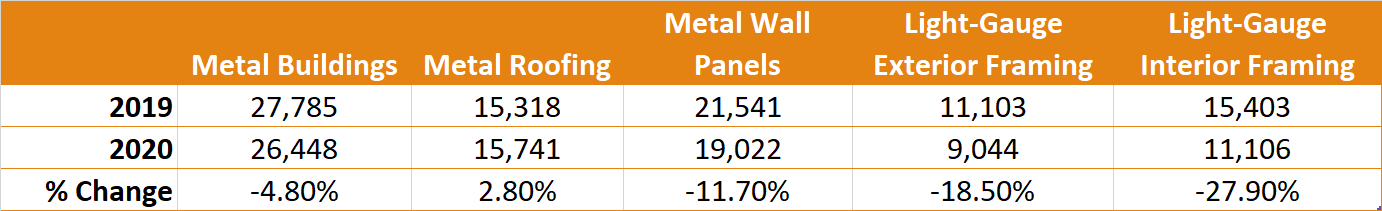

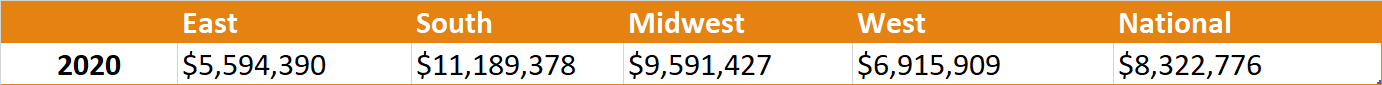

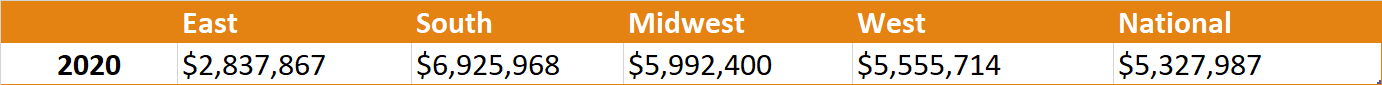

According to respondents to the 40th Annual Contractor Survey, the average size of metal building projects declined only 4.8% in 2020 and metal roofing actually increased just under 3%. It should be noted that respondents to this year’s survey reported higher annual sales. This year’s survey takes reported 2020 national average gross contracting sales of $8,322,776 compared to last year’s respondents reporting $5,061,052 in 2019. On metal projects (metal building systems, roofing, wall panels and light-gauge steel framing) the numbers were also higher—$5,327,987 for 2020 and $3,300,434 for 2019.

There are two reasons for this and neither of them is that annual revenues grew in 2020 compared to 2019. The first reason is that on average, the firms responding to this year’s survey were larger than last years and included a handful of very large firms. The second reason is in the nature of economic surveys. Those who respond tend to be those who are doing well.

One segment of the industry that is doing well is the residential market—both new construction and remodeling. According to the U.S. Census Bureau, approximately 1,380,300 housing units were started in 2020, which includes single family and multifamily. In 2019, starts totaled 1,290,000, so last year, in the middle of a massive pandemic during a historic economic downturn, residential construction increased about 7%.

Coming out of 2020, residential remodeling activity is expected to be even more robust. The Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University publishes an annual Leading Indicator of Remodeling Activity (LIRA). It reports remodeling activity in 2020 increased 3.5% year-over-year compared to 2019. Looking forward, that rate of activity is expected to increase even more, going up to 3.8% by year end. What’s even more surprising is that the LIRA anticipated growth in 2020 was to be approximately 2%, so the actual increase far outstripped predictions.

Average Square Footage Increase by Metal Building Product

General Statistics

2019 was the culmination of a 10-year expansion of the construction industry, which was followed by an unprecedented downturn in 2020. While we say “unprecedented,” we mean really the cause of the decline and the uncertainty that entailed. There have been far worse years in construction than 2020. Last year, our uncertainty was the defining characteristic, though.

To accent that issue, the total annual sales for 2020 reported by our respondents was $8,322,776, which was more than $3 million above that reported last year for 2019. However, it is much more in keeping with total annual sales reported in previous surveys. For example, in our survey from 2019, respondents reported $8,872,079 annual sales, which is slightly more than this year.

When looking at metal project sales, we get a slightly different story. Last year, respondents reported $3,300,434 in metal project sales compared to this year’s $5,327,987. That increase follows the pattern—if not the exact percentage increase—of the year-over-year change. In other words, metal project sales grew, but only in rough proportion to total sales.

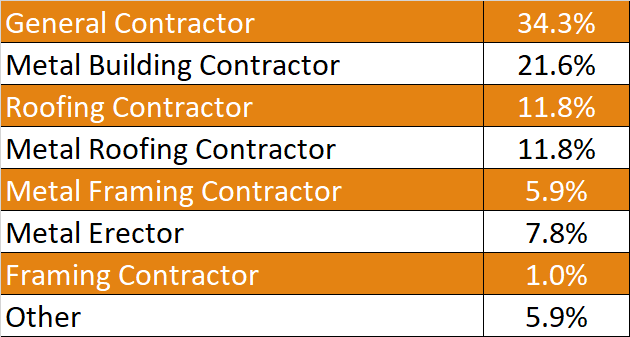

Much of those results can be explained by the types of companies that responded to the survey this year. Compared to 2020, there were two significant cohort changes in the percentage of respondents: metal building contractors and framing contractors. The other cohorts remained roughly the same. Last year, 13.2% of our survey takers were metal building contractors, but this year, that number jumped to 21.6%. At the same time, those self-reporting as framing contractors dropped from 6.6% to 1%.

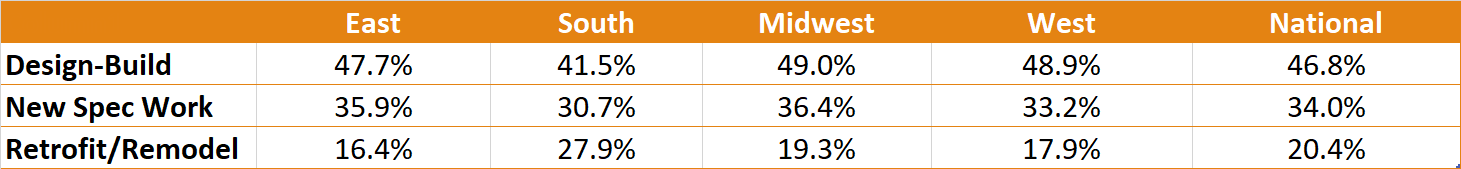

In our other two categories of general statistics, we ask survey takers about the kinds of construction contracts they use. Across the years, the numbers reporting their use of design/build (46.8%), new spec work (34%) or retrofit/remodel contracts (20.4%) has remained roughly the same.

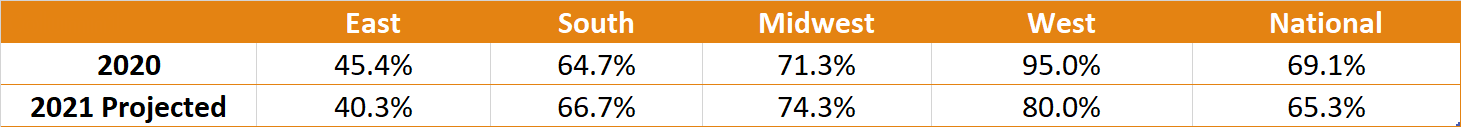

For those reporting the involvement in architects over the years, the percentage has hovered between 60% and 70%. This year, respondents said 69.1% of the projects in which they were involved included architects and they projected that in 2021 that would decrease slightly to 65.3%.

(Percentages may not add up to 100% due to rounding.)

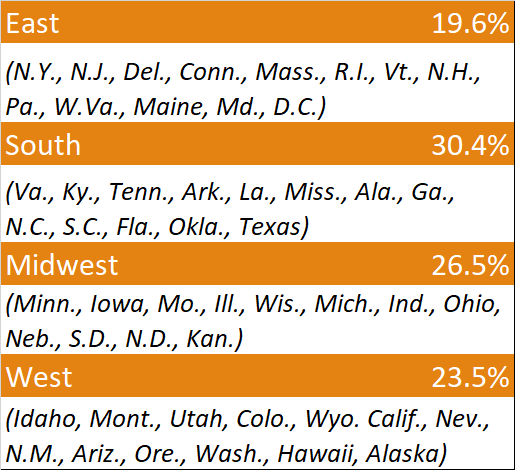

Company Location

Type of Firm

Average Annual Gross Contracting Sales Volume

Average Metal Project Sales Volume

Breakdowns of Metal Construction Contracts

Amount of Metal Construction Projects Involving Architects

Metal Buildings

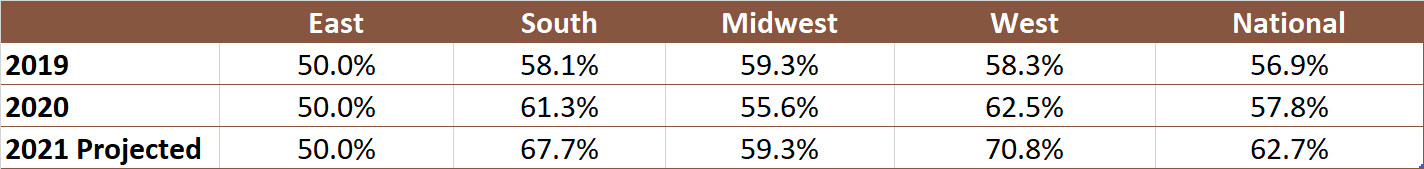

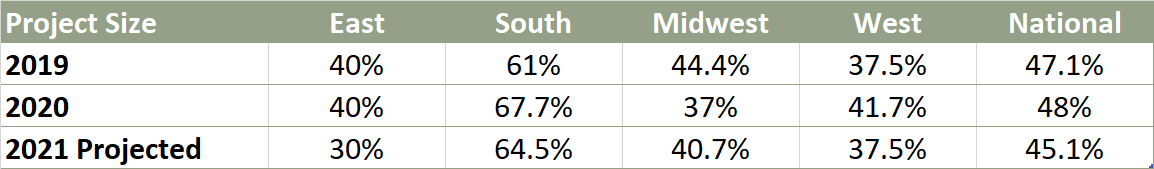

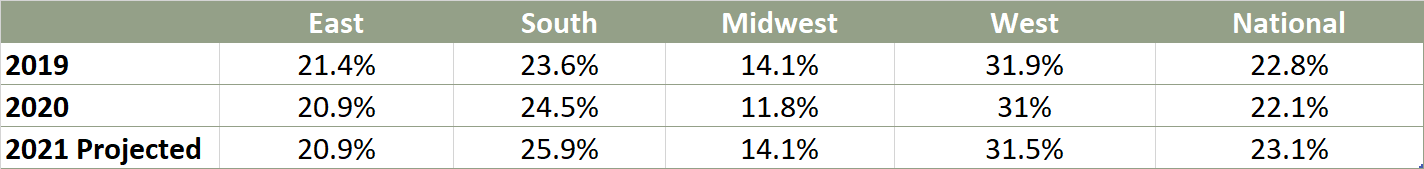

The number of respondents reporting their involvement in metal building construction the previous year remained relatively consistent with the 2020 survey. Last year, 53.6% of survey takers said they were involved in metal building construction. This year, that increased slightly to 57.8%. In a significant difference from previous year’s surveys, the respondents to this question were relatively even across all regions. Often, one region responds much more strongly while another is weaker in its involvement.

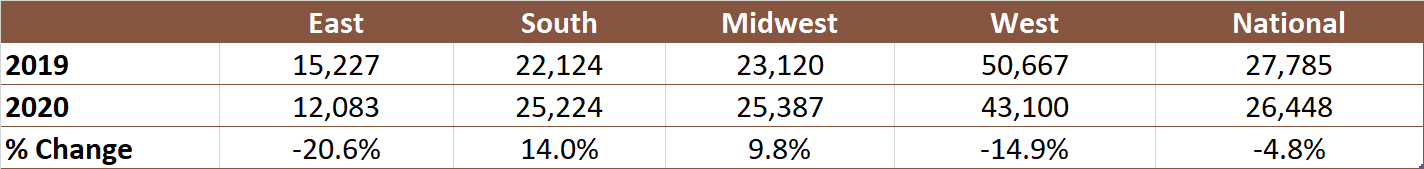

The size of metal buildings completed declined, according to this year’s respondents. They said the average size of a metal building in 2019 was 27,785 square feet. The 2020 average size metal building, according to this year’s respondents, was 26,448 square feet, which was a 4.8% decrease.

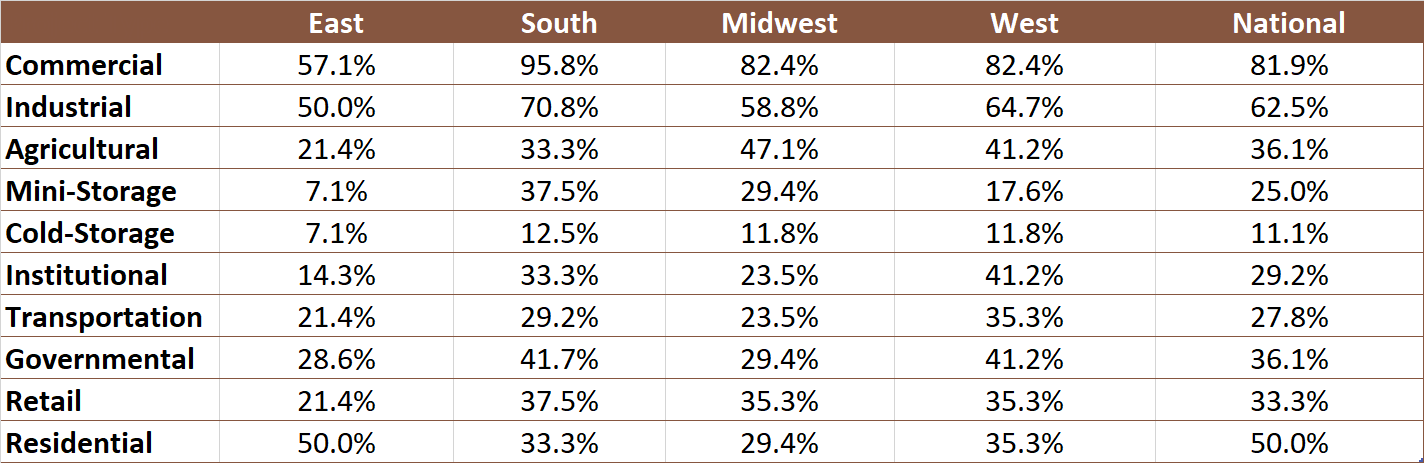

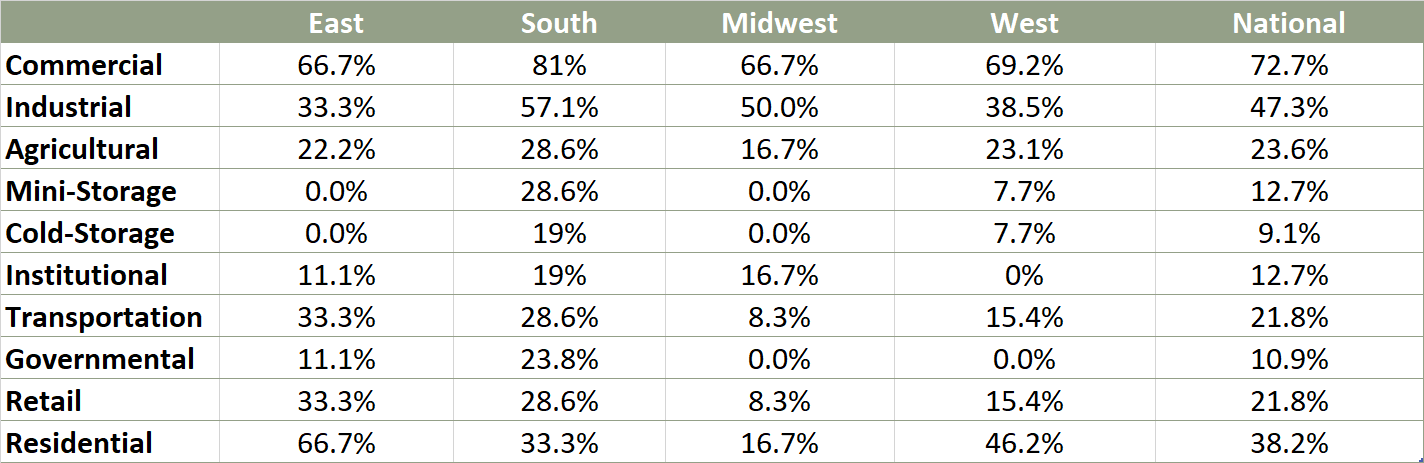

The most common type of metal building completed nationally was a commercial project (81.9%), although among our respondents from the eastern region, only 57.1% of them said they did commercial projects. The second most common type of metal building construction was for industrial projects at 62.5%.

Number of Respondents Involved in Metal Building Construction

Average Number of Metal Buildings Completed per Those Involved

Average Square Footage of Metal Buildings Completed

Percentage of Contractors Involved in Metal Building Project Types in 2017

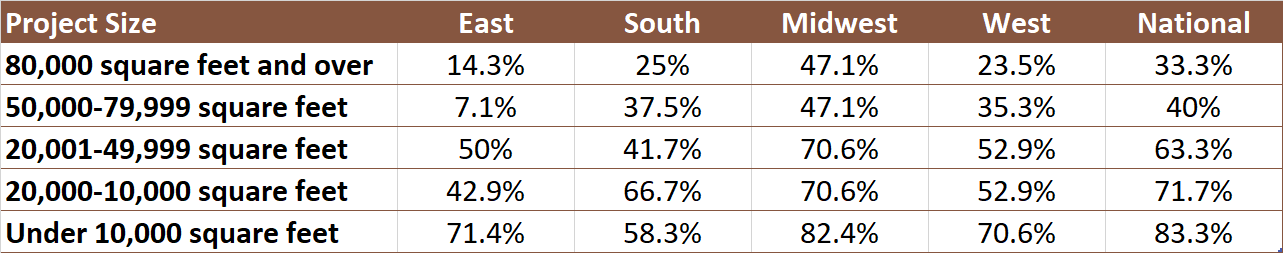

Metal Building Projects Completed, According to Building Size

Metal Roofing

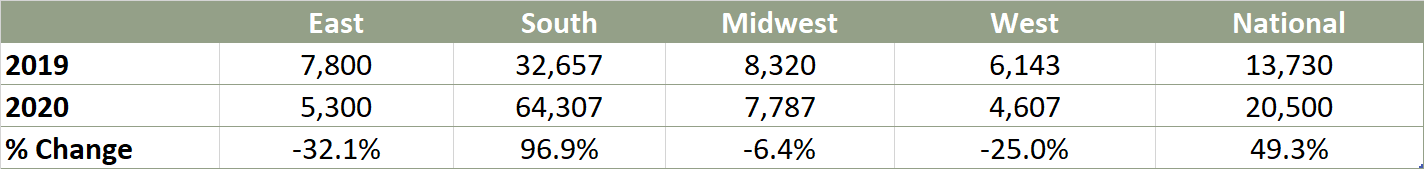

This year, we had a significantly higher percentage of our respondents who said they did metal roofing projects compared to the 39th Annual Survey in 2020. Last year, 36.8% of survey takers said they did a metal roofing project in the previous year, as opposed to the 48% who said they did metal roofing projects in 2020.

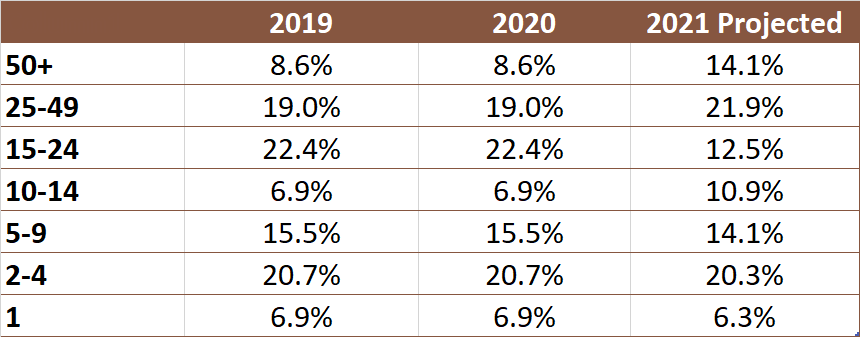

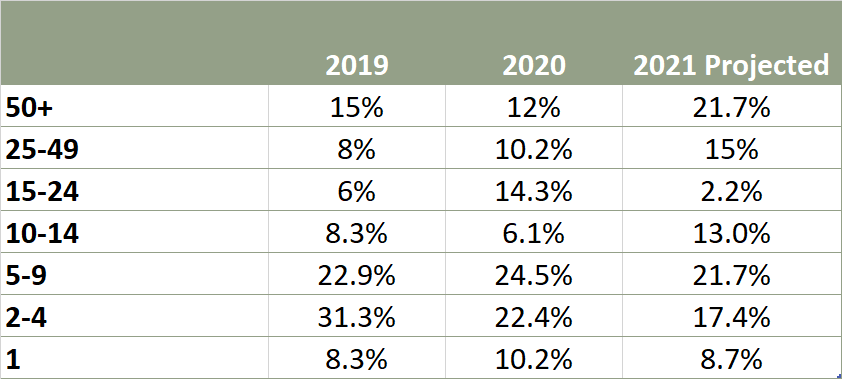

About half (49.9%) said they did between two and nine metal roofing projects in 2020, and about 22% said they did more than 25 projects. This groups projections for 2021 were much more optimistic, though. About 37% said they anticipated doing more than 25 metal roofing projects in 2021, while only 38.9% said they would do between two and nine metal roofing projects.

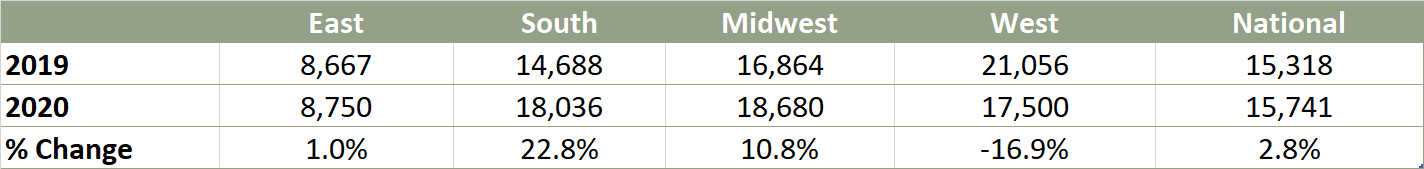

Interestingly, compared to last year’s survey, the size of the metal roofing projects has decreased significantly. Last year, respondents said their average metal roof project was 26,841 square feet in 2019. This year, survey takers said their average metal roof project was 15,741. That major drop may be attributable to a higher percentage of respondents doing smaller residential roofs compared to previous years.

This conclusion is supported by the report on the average size of a metal roof on a non-metal building, which most assuredly is not a residential project. In this case, the average size of a metal roof in 2020 reported by this year’s respondents was 20,500 square feet, which is comparable to the 21,812 square feet reported last year on projects completed in 2019.

Number of Respondents Involved in Metal Roofing Construction

Average Number of Metal Roofs Completed per Those Involved

Average Square Footage of Metal Roof Projects Completed

Percentage of Contractors Involved in Metal Roofing Types

Percentage of New Metal Roofing on Non-metal Buildings

Average Square Footage of New Metal Roofs on Non-metal Buildings

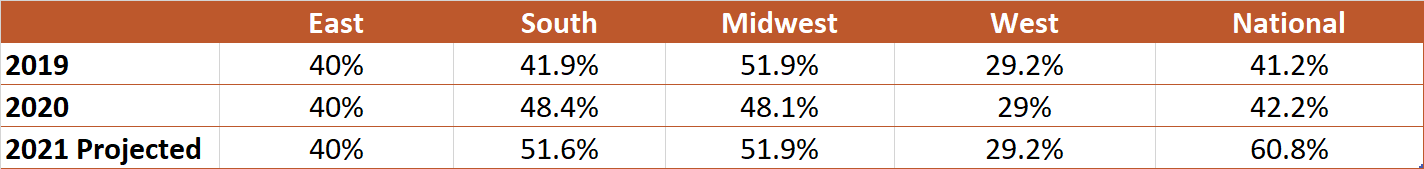

Metal Wall Panels

Similar to the metal roofing respondents, this year we had a much higher percentage of respondents reporting their involvement in metal wall panel projects than in the previous year. And, similar to metal roofing category, this year’s number of respondents more closely matched those of the 2019 survey. Just over 42% or our survey takers say they participated in metal wall panel projects in 2020. In the 2020 survey, only 30.3% claimed that about the previous year. Nationally, more than 60% expect to be involved in metal panel projects in 2021.

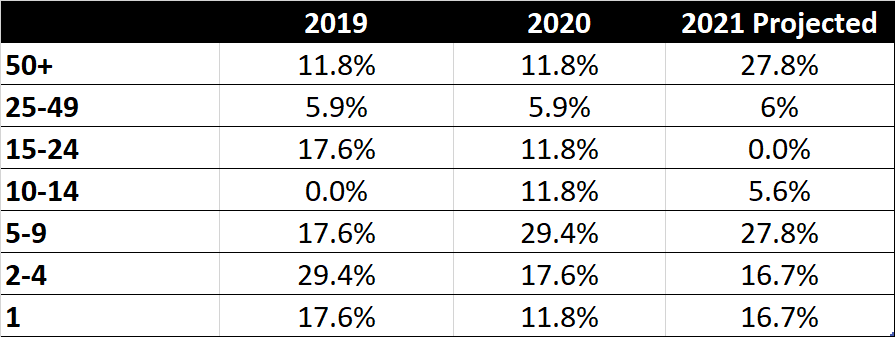

That jump will come primarily from companies who expect to do more than 50 projects next year. In 2020, 11.8% of respondents said they did more than 50 projects, but in 2021, nearly 30% of respondents anticipate doing more than 50 metal wall panel projects. On the lower end, about 47% report doing one to four projects in 2020, but only 33.4% anticipate doing that few projects in 2021.

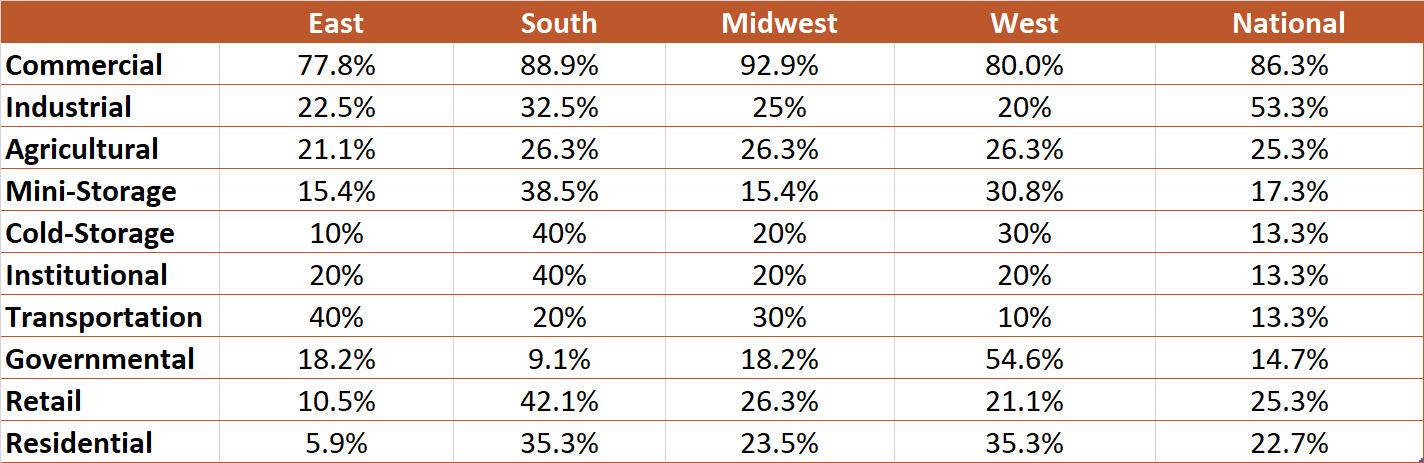

As usual, the vast majority of project types fits into the commercial construction category (86.3%), but industrial comes close behind (53.3%) followed by agricultural (25.3%), retail (25.3%) and residential (22.7%). Anecdotal reports of the increase in the use of metal wall panels in residential construction are not proved out by our survey, which has shown involvement in residential construction to be consistently between 22 and 24% for the last few years.

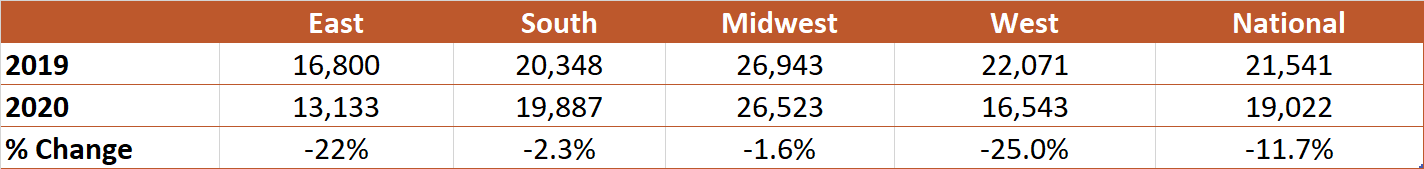

The average project size for our respondents was 19,022 square feet in 2020. That was an 11.7% decrease over the previous year. Companies working in the east tended to work on smaller projects, 13,133 square feet, and the same group reported a decline in square footage from 2019 to 2020 at 21.8%.

Number of Respondents Involved in Metal Wall Panel Construction

Average Number of Metal Wall Panel Projects Completed per Those Involved

Average Square Footage of Metal Wall Panels Construction

Percentage of Contractors Involved in Metal Wall Panel Construction Types

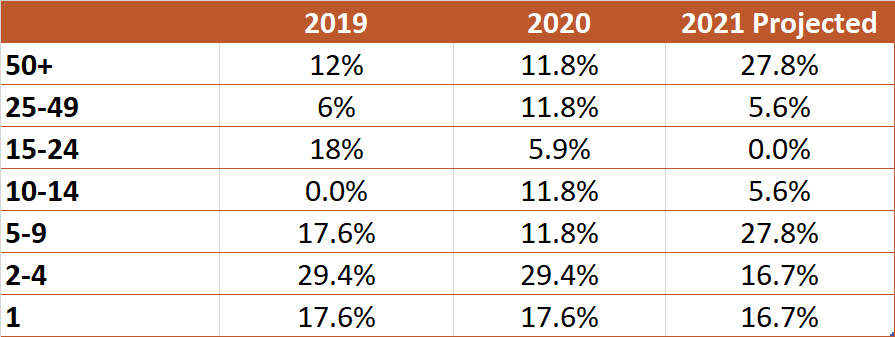

Light-Gauge Steel Framing

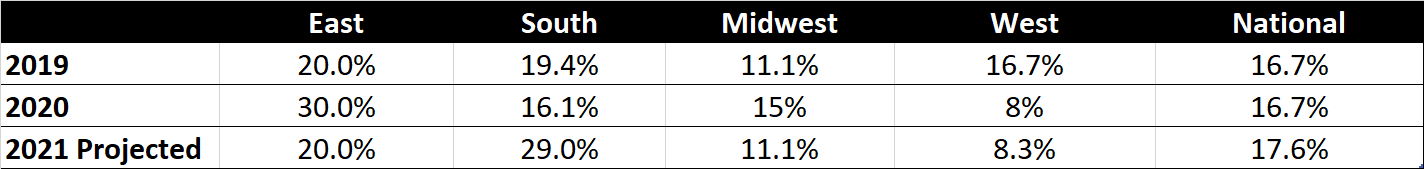

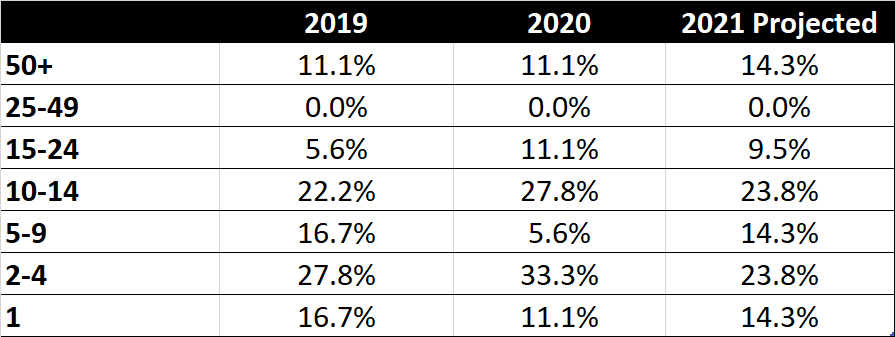

This year, we had about the same percentage of respondents to our survey who indicated they had completed light-gauge metal exterior framing projects in 2020 (16.7%) as compared to those who responded last year and reported on numbers for 2019 (20%). The survey takers expect a slight increase in their involvement in light-gauge steel framing projects for 2021.

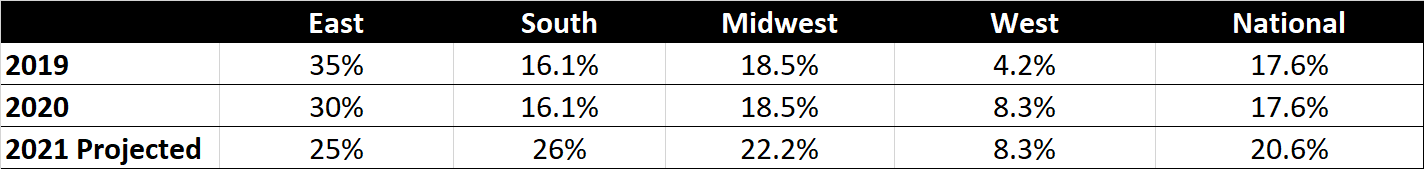

For interior projects, the involvement came in at 17.6% for 2020, which was roughly equivalent to last year’s numbers, and the 2021 respondents expected a minor increase 20.6%.

Notably, the number of respondents who anticipated doing more than 50 projects in 2021 jumped from 11.8% to 27.8%, while the other cohorts for both exterior and interior framing held essentially steady.

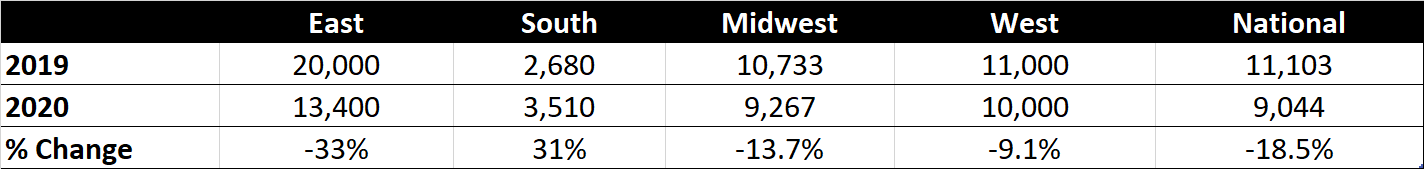

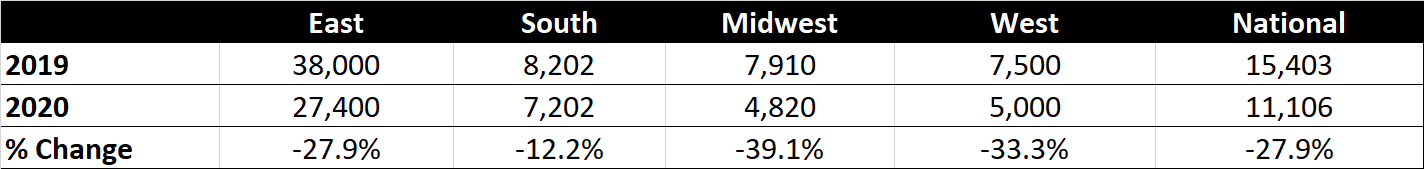

Respondents who do exterior framing report a decrease in the average size of the projects they completed in 2020. Down from 11,103 square feet in 2019 to 9,044 square feet, which is a total decline of 18.5%. On the interior side, the same story of declining size holds. In 2019, respondents did projects with an average size of 15,403 square feet, but that dropped to 11,106 square feet in 2020, which is a decline of 27.9%.

Number of Respondents Involved in Light-Gauge Exterior Framing

Average Number of Light-Gauge Exterior Framing Projects Completed per Those Involved

Average Square Footage of Light-Gauge Exterior Framing Projects

Number of Respondents Involved in Light-Gauge Interior Framing

Average Number of Light-gauge Interior Framing Projects Completed per Those Involved

Average Square Footage of Light-Gauge Interior Framing Projects

- 2021 Survey: https://www.metalconstructionnews.com/articles/40th-annual-contractor-survey

- 2020 Survey: https://www.metalconstructionnews.com/articles/39th-annual-contractor-survey

- 2019 Survey: https://www.metalconstructionnews.com/articles/38th-annual-mcn-contractor-survey

- 2018 Survey: https://www.metalconstructionnews.com/articles/37th-annual-contractor-survey

- 2017 Survey: https://www.metalconstructionnews.com/articles/36th-annual-contractor-survey

- 2016 Survey: https://www.metalconstructionnews.com/articles/35th-annual-contractor-survey

- 2015 Survey: https://www.metalconstructionnews.com/articles/34th-annual-mcn-contractor-survey

- 2014 Survey: https://www.metalconstructionnews.com/articles/33rd-annual-metal-construction-news-contractors-survey

- 2013 Survey: https://www.metalconstructionnews.com/articles/32nd-annual-metal-construction-news-contractors-survey

- 2012 Survey: https://www.metalconstructionnews.com/articles/metal-construction-news-2011-contractors-survey

- 2011 Survey: https://www.metalconstructionnews.com/articles/metal-construction-news-2010-contractor-survey

Source URL: https://www.metalconstructionnews.com/articles/40th-annual-contractor-survey/