Metal Roofing Supply Chain

by Jonathan McGaha | 27 January 2016 12:00 am

An efficient and flexible supply chain serves installers in the way they want

A cottage industry has erupted across the country, filled with academicians studying the building products supply chain. The reason is that in contrast to supply chains for other industries, the building products chain has been notoriously slow to adapt new technologies and find increased efficiencies. For both general and trade contractors that means the materials and services they require on-site are more difficult to manage, which can eat into profitability.

That’s not to say that there hasn’t been change. The insulation supply chain serving the residential market has consolidated to the point that distribution and installation are managed by the same companies, and just a few of those companies have gained considerable market share. And increasingly, manufacturers are skipping the distribution middlemen and shipping material directly to the contractor. The main two motivations for such a move are to remove costs from the supply chain and give the manufacturer greater control over the end product.

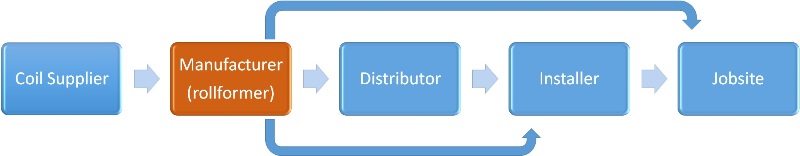

| Rollformer at Manufacturer |

|

|

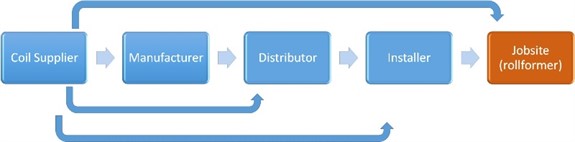

When the manufacturer does the rollforming and then distributes the finished metal roofing, the supply chain takes on a traditional appearance. Each of the players adds value to the process, whether it’s warehousing or financing or market support. Manufacturers may also distribute directly to the installer or even send material right to the job site. The variations depend on the capability of the installer, the size of the job, the need to exercise control over the final product and the warranty offered, among other factors. |

In the metal roofing supply chain, the variety of methods being used to get the material to market is incredibly diverse and varied. In a traditional distribution model, the coil supplier ships to the manufacturer, who makes the metal roofing, then uses a distribution network to get the material to the market. Contractors work with distributors to receive material and transport it to the job site.

End User

The most important influence on the supply chain is the end use of the material. Will the material be used on a home or building? Typically, the contractors serving those markets are exclusive to the markets, although many metal roofing contractors will work on both residential and commercial projects.

About 8.5 percent of the residential roofing market is metal roofing, according to the Metal Roofing Alliance, and the vast majority of that is in the retrofit market. Consequently, installers need a variety of services to support their installation. A direct-to-contractor distribution model won’t work because a manufacturer can’t just pull an 18-wheeler into an established residential neighborhood and offload material onto a driveway. There needs to be an intermediary step.

|

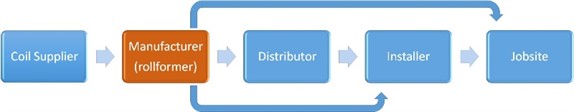

Rollformer at Distributor |

|

|

Many distributors receive coils and manufacture their own metal roofing. That may be done independently or in conjunction with a manufacturer. In the latter case, the distributor’s product is tightly controlled by the manufacturer, building to its specifications and meeting its warranties. One advantage of this scenario is that installers can get materials much quicker because the distributor will warehouse coils and can turnaround product in a matter of days. |

On the commercial side, though, that is possible on big jobs, and some manufacturers do package and ship roofing material directly to a job site.

The needs of the end user also vary by geographic location. Regional trends in distribution affect the supply chain. For example, a strong distribution market in the southeastern United States provides a sophisticated infrastructure that manufacturers can take advantage of and don’t need to replicate.

The variances also occur in urban versus rural markets. Distributors in urban markets tend to be more highly niched, so they specialize in metal roofing or roofing only. In rural markets, where distributors need to expand services to grow the company, they will offer a wider variety of building products and services. A wholesale distributor in a rural market offers retail services as well.

|

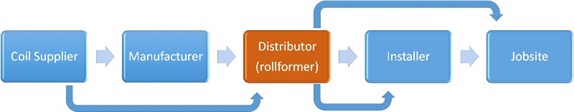

Rollformer at Installer |

|

|

Large installers may own their own rollforming equipment, which gives them some of the attributes of a distributor, although they likely won’t sell to other contractors. If the installer is also receiving coil directly, it may be more similar to a manufacturer. In that case, the burden of market support and brand creation falls almost entirely on the installer. |

Added Value

Distributors offer far more value to their customers than just a transfer of materials from a large truck to a small truck and then delivering it. Metal roofing panels, whether rolled or stamped, require an array of other materials for proper installation: underlayment, vapor retarders, fasteners and sealers. Distributors bundle that material and deliver to the job as a whole so contractors don’t need to send employees all over town to hunt up screws and caulk and other small items.

The distributor network also provides financing to contractors, offering credit that contractors need to manage cash flow. On top of that, distributors will provide marketing support, advertising metal roofing in the local market to drive demand and doing co-op advertising with contractors.

The number of services distributors offer can vary considerably depending on the type of distributor they are and the needs of their customers. For distributors working with large, sophisticated contractors, the marketing and financing support may be minimal and they may focus more on warehousing material and just-in-time delivery.

Enter the Rollformer

One of the reasons the building products supply chain is less efficient than other supply chains is that every job site is its own manufacturing facility. Raw materials in the form of different building products arrive on-site where the crews complete the final step of the manufacturing process.

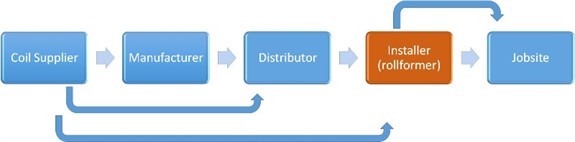

|

Rollformer on Job Site |

|

|

Portable rollformers give all members of the supply chain the opportunity to ship directly to the job site. The machinery may be operated by crews from a manufacturer, distributor or installer. This kind of flexibility pushes the manufacturing process right to the front lines and allows the supply chain to deliver large amounts of product efficiently. Control over the final product can vary and it requires that the stakeholders ensure the proper training and market support to meet warranty issues. |

For the metal roofing supply chain, this is even more convoluted because of the importance of rollforming machines. The rollforming machine can be insinuated at any step in the supply chain, completely altering the dynamic of supplier and customer. The final metal roof may be manufactured in a plant far from the building site or, with the advent of portable rollforming machines, it may actually occur on the job site.

At that point the question becomes who is controlling the rollforming machine? Depending on a manufacturer’s unique go-to-market strategy, the job-site machine may be operated by a company on the distribution chain. It could be the manufacturer or the distributor who is rollforming the material, which is handed off to the installer right on the job site.

The rollformer also means that local markets can be efficiently served by almost anyone, whichincreases low-priced competition. A company purchasing low-cost steel coils manufactured overseas is in direct competition with U.S. manufacturers offering metal roofing made from U.S. produced steel.

All of the services and needs in the distribution for metal roofing material is completely upended by where the rollforming occurs in the distribution chain.

Controlling the Outcome

So, how do companies compete in a supply chain that includes a disruption such as low-priced steel? Most of the manufacturers, whether they are making roofing material in centralized facilities or completing the process on the job site with their own machines, compete on quality.

The approach they take is that the roof is an entire system and the only way to control that is to offer a wide variety of services that ensure the final product will perform at the level expected for metal roofing. In such cases, the companies that are supplying the material, who also are the ones ultimately liable for its performance, use warranties as a mechanism for ensuring quality and differentiating themselves from low-priced competition. (While low price is common, competitors offering low-quality roofing may be charging higher prices.) To earn the warranty, the roof system must be built to the standards established by the manufacturer. There are a number of ways companies work to ensure their products are installed to their standards.

Some require inspections at multiple stages of the construction project, starting with a pre-construction meeting to make sure all the stakeholders understand the process and their responsibilities. Manufacturers and distributors provide significant training, both at in-house facilities designed specifically for training and on the job site. High-value companies offer additional back-office services to help distributors and installers meet standards, including engineering and other technical assistance.

Sources

The following people generously provided information and guidance for this article.

Jim Bush, vice president of sales, ATAS International Inc., Allentown, Pa.

Ken Gieseke, vice president of marketing, McElroy Metal, Bossier City, La.

Bill Hippard, executive director, Metal Roofing Alliance

Peter Landy, national director of distribution and logistics, Englert Inc., Perth Amboy, N.J.

Brian Partyka, president, Drexel Metals Inc., Louisville, Ky.

Mike Petersen, president, Petersen Aluminum Corp., Elk Grove Village, Ill.

Andrea Spinelli, Studio 27 Media, Lake Hopatcong, N.J.

Source URL: https://www.metalconstructionnews.com/articles/metal-roofing-supply-chain/