Construction jobs growth continues with 25K gain

by Christopher Brinckerhoff | 16 October 2024 6:00 am

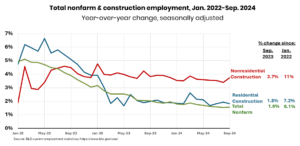

[1]Construction employment, seasonally adjusted, totaled 8,303,000 in September, a gain of 25,000 from August and 238,000 (3 percent) year-over-year (y/y), according to an Associated General Contractors’ (AGC) analysis[2] of data the U.S. Bureau of Labor Statistics (BLS). The y/y growth rate outpaced the 1.6 percent increase in total nonfarm payroll employment. Residential construction employment rose by 7,800 in September (2,000 at residential building firms and 5,800 at specialty contractors) and 60,500 (1.8 percent) y/y. Nonresidential construction employment increased by 17,900 for the month (3,800 at heavy and civil engineering construction firms and 17,000 at specialty trade contractors, offsetting a decline of 2,000 at building firms) and 177,800 (3.7 percent) y/y. Seasonally adjusted average hourly earnings for production and non-supervisory employees rose 3.9 percent y/y for the total private sector and 4 percent for construction (i.e., most craft and office workers). The industry unemployment rate in September, not seasonally adjusted, was 3.7 percent, which was lower than the all-industry rate (3.9 percent, not seasonally adjusted) for the fourth consecutive month. The number of unemployed jobseekers with construction experience totaled 403,000, not seasonally adjusted, an increase of 11,000 (2.8 percent) y/y.

[1]Construction employment, seasonally adjusted, totaled 8,303,000 in September, a gain of 25,000 from August and 238,000 (3 percent) year-over-year (y/y), according to an Associated General Contractors’ (AGC) analysis[2] of data the U.S. Bureau of Labor Statistics (BLS). The y/y growth rate outpaced the 1.6 percent increase in total nonfarm payroll employment. Residential construction employment rose by 7,800 in September (2,000 at residential building firms and 5,800 at specialty contractors) and 60,500 (1.8 percent) y/y. Nonresidential construction employment increased by 17,900 for the month (3,800 at heavy and civil engineering construction firms and 17,000 at specialty trade contractors, offsetting a decline of 2,000 at building firms) and 177,800 (3.7 percent) y/y. Seasonally adjusted average hourly earnings for production and non-supervisory employees rose 3.9 percent y/y for the total private sector and 4 percent for construction (i.e., most craft and office workers). The industry unemployment rate in September, not seasonally adjusted, was 3.7 percent, which was lower than the all-industry rate (3.9 percent, not seasonally adjusted) for the fourth consecutive month. The number of unemployed jobseekers with construction experience totaled 403,000, not seasonally adjusted, an increase of 11,000 (2.8 percent) y/y.

Construction spending (not adjusted for inflation) totaled $2.13 trillion in August at a seasonally adjusted annual rate, down 0.1 percent from the downwardly revised July rate but up 4.1 percent y/y, the Census Bureau reported[3] on Tuesday. Private nonresidential spending dipped 0.1 percent for the month. The largest subsegment, manufacturing, rose 0.2 percent; power construction slumped 0.7 percent; commercial slid 0.4 percent (comprising warehouse, up 0.5 percent; retail, down 2.3 percent; and farm, up 2 percent); and office rose 0.2 percent (with data centers up 1 percent and other “offices” down 0.2 percent). Private residential spending declined 0.3 percent (single-family, down 1.5 percent; multifamily, down 0.4 percent; and improvements, up 1 percent). Public construction climbed 0.3 percent, with highway and street up 1.1 percent; education flat; transportation down 0.2 percent; and sewage and waste disposal down 0.5 percent.

There were 370,000 job openings in construction, seasonally adjusted, at the end of August, a drop of 16,000 (-4.1 percent) y/y, BLS reported[4] on Tuesday. Hires for the full month totaled 338,000, a drop of 36,000 (-9.6 percent). Layoffs and discharges totaled 164,000 or 2 percent of employees, the second-lowest August rate in the 24-year history of the data. The fact that end-of-month openings exceeded hires for the full month suggests employers wanted to hire more than twice as many workers as they were able to; the low layoff rate indicates firms want to hang onto workers.

- [Image]: https://www.metalconstructionnews.com/wp-content/uploads/2024/10/ConstructionEmplSep2024_.png

- analysis: https://www.agc.org/sites/default/files/users/user21902/Employment-AHE%20table%20Sep_2.pdf

- reported: https://www.census.gov/construction/c30/current/index.html

- reported: https://www.bls.gov/jlt/#data

Source URL: https://www.metalconstructionnews.com/news/industry-news/construction-jobs-6/