After a year with a major blip in the economy, the construction industry trends toward a robust 2015

Do you remember back to the frigid days of early 2014? Nearly 75 percent of the country was under snow and temperatures in the northern cities clung to frigid. The conversation was about the Polar Vortex and the economy was slumping with all the grace of a drunk caught in a snowdrift.

As we approach winter again, it looks like sunnier days are here. All the major economic signs are pointing toward growth and the predictions for the construction industry (check out the State of the Industry report on page 16) are generally positive. Of course, there’s plenty of uncertainty in the air as well. While plummeting oil prices are good at the gas pump, that also translates into reduced investments in exploration and hits on other parts of the energy sector. Still, we have reason to breathe a little easier.

One last bit of the puzzle for economic growth seems to be falling into place also. Wages are rising, which means consumers will have a few extra coins in their pockets-or rather going into their pockets and going right back out again.

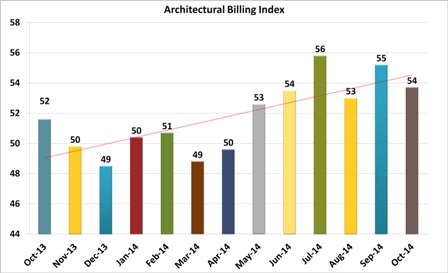

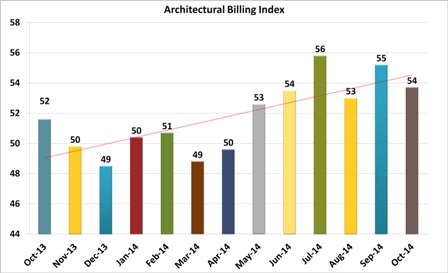

Architectural Billing Index

(Click image to view larger)

The Architectural Billing Index is a report generated by a poll of architects done by the American Institute of Architects and weighted for various factors. It reflects the work on the books at architectural firms. An index number below 50 is a negative assessment, but above 50 shows promise for growth.

It reflects as clearly as any economic report on the construction industry the depths of the doldrums we experienced last winter. While not a true leading indicator of construction activity, it does serve as such for most participants. Contractors and building product manufacturers can get a sense of their future business by seeing what architects have on their boards.

By that measurement, 2014 has been a pretty good year. We’ve had a couple of dips, but you can see from the trend line that we’ve also had a strong, general upward trend. Compared to the index in 2013, this is about as positive as we can get.

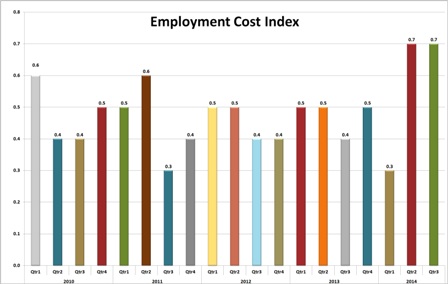

Employment Cost Index

(Click image to view larger)

Anybody who watches the financial reporting and listens to any pundit/economist has been hearing plenty of discussion about flat wages. Both sides of the political aisle have pointed to this to score political points: the left claim the private sector is profiteering from a growing economy and the right claim the growth is not a true boom, but only fundamentally flawed.

Well, both sides have good news now. Compensation costs for civilian workers increased 0.7 percent, seasonally adjusted, for the three-month period ending September 2014, the U.S. Bureau of Labor Statistics recently reported. Wages and salaries (which make up about 70 percent of compensation costs) increased 0.8 percent, and benefits (which make up the remaining 30 percent of compensation) increased 0.6 percent.

For the prior 12-month period, compensation costs for civilian workers increased 2.2 percent, which is the first time in nearly 12 quarters that any period increased more than 2.0 percent. Service industry workers saw smaller increases (1.8 percent) compared to workers in natural resources, construction and maintenance occupations, and production, transportation and material moving

(2.4 percent).