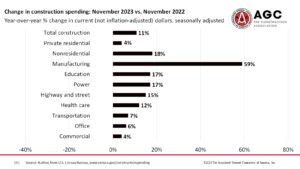

Image courtesy Associated General Contractors of America (AGC)

Contractors are generally optimistic about the outlook for nonresidential and multifamily construction in 2024, but optimism is less widespread than a year ago, based on Associated General Contractors of America’s (AGC) AGC-Sage survey.

The survey—“A Construction Market in Transition: The 2024 Construction Hiring and Business Outlook”—included 1,293 responses submitted Nov. 9 to Dec. 8. Respondents were asked whether the dollar value of projects they compete for would be higher or lower in 2024. The net reading (percentage of respondents expecting a higher dollar value less the percentage expecting a lower value) was positive for 14 out of 17 project types.

The broadest optimism was for water and sewer projects, with a net positive reading of 32 percentage points, followed by highway and bridge projects, and transportation facilities, 30 each; federal agency work, 37; power, 25; hospital, 23; other healthcare (such as clinics, labs, and testing facilities), 22; data centers, 20; K-12 schools, 18; higher education, manufacturing, and public building construction, 15 each; warehouse, 10; and multifamily, 4. Net readings were negative for lodging, -3; retail, -15; and office, -24.

As in 2023, 69 percent of firms expect to add employees. But 55 percent of respondents expect doing so will be as hard as or harder than in 2023.

Construction contractors have a decidedly mixed outlook for 2024 as firms predict transitions in demand for projects, the types of challenges they will face, and the technologies (including artificial intelligence) they will embrace, according to the survey.

Amid these changes, contractors are struggling to cope with significant labor shortages, the impacts of higher interest rates and input costs, and a supply chain that, while better, is still far from normal, according to the survey.

Stephen Sandherr, CEO at AGC, says, “2024 offers a mixed bag for construction contractors. On one hand, demand for many types of projects should continue to expand and firms will continue to invest in the tools they need to be more efficient. Meanwhile, they face significant challenges when it comes to finding workers, coping with rising costs, and weathering the impacts of higher interest rates.”