Image courtesy Associated Builders and Contractors (ABC)

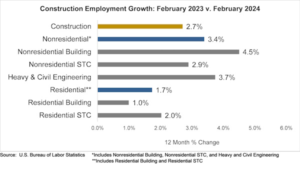

The construction industry added 23,000 jobs in February, according to an Associated Builders and Contractors (ABC) analysis of data released by the U.S. Bureau of Labor Statistics. On a year-over-year basis, industry employment has expanded by 215,000 jobs, an increase of 2.7 percent.

Nonresidential construction employment grew by 24,200 positions, with growth in all three subcategories. Heavy and civil engineering gained the most jobs, increasing by 12,500 positions. Nonresidential specialty trade and nonresidential building added 7,400 and 4,300 jobs, respectively.

The construction unemployment rate rose to 7 percent in February. Unemployment across all industries increased from 3.7 percent in January to 3.9 percent in February.

“In February, we saw evidence that contractors continue to add workers, fulfilling expectations,” says Anirban Basu, chief economist at ABC. “Employment growth happened in a variety of nonresidential subsegments, which is quite remarkable given headwinds such as high project financing costs, elevated construction service delivery costs, and lingering recessionary fears.

“Though the February jobs report and the Construction Confidence Index data both indicate ongoing industry momentum, there remain reasons for concern,” says Basu. “Contractors whose clients are project owners who rely on the availability of private financing have been reporting higher numbers of project delays. ABC’s Construction Backlog Indicator declined [in February], indicating that, while the industry continues to expand, a growing fraction of nonresidential contractors may be feeling the effects of a still-restrictive monetary environment.”