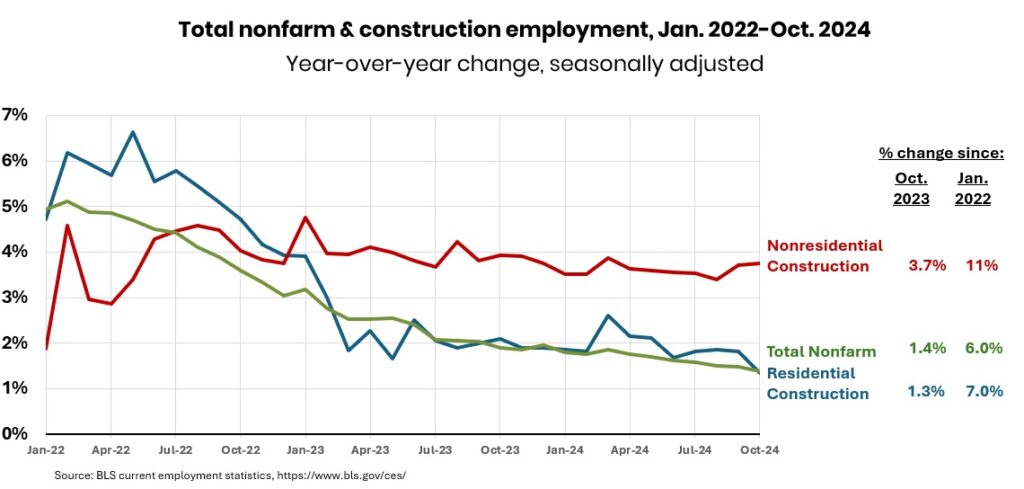

Construction employment, seasonally adjusted, totaled 8.31 million in October, a gain of 8,000 from September and 223,000 (2.8 percent) year-over-year (y/y), according to Associated General Contractors of America’s (AGC) analysis of data from the Bureau of Labor Statistics (BLS). The y/y growth rate doubled the 1.4 percent increase in total nonfarm payroll employment. Residential construction employment fell by 5,300 in October (up 1,300 at residential building firms and down 6,600 at specialty contractors) but rose by 44,500 (1.3 percent) y/y. Nonresidential construction employment increased by 13,500 for the month (up 300 at building firms and 13,500 at specialty trade contractors, but down 1,100 at heavy and civil engineering construction firms) and 178,400 (3.7 percent) y/y. October employment was likely held down by hurricane disruptions in the Southeast.

Labor costs for nonresidential firms outpaced other sectors: seasonally adjusted average hourly earnings for production and nonsupervisory employees rose 4.1 percent y/y for the total private sector and 4.5 percent for construction (i.e., most craft and office workers). The industry unemployment rate in October, not seasonally adjusted, was 4.2 percent, up from 4 percent in October 2023, and the number of unemployed job seekers with construction experience totaled 456,000, up by 42,000 (10 percent) y/y.

Construction spending (not adjusted for inflation) totaled $2.15 trillion in September at a seasonally adjusted annual rate, up 0.1 percent from the upwardly revised August rate and up 4.6 percent y/y, the U.S. Census Bureau reported. Private nonresidential spending dipped 0.1 percent for the month. The largest subsegment, manufacturing, slipped 0.2 percent; power construction inched down 0.1 percent; commercial rose 0.2 percent (comprising warehouse, up 0.8 percent; retail, down 0.5 percent; and farm, up 0.1 percent); and office rose 0.6 percent (comprising data centers, up for the 14th straight month, by 0.6 percent, and other offices, down for the 10th month in a row, by 0.7 percent). Private residential spending rose 0.2 percent (single-family, up 0.4 percent; multifamily, down 0.1 percent; and improvements, unchanged). Public construction rose 0.5 percent, with highway and street spending up 0.5 percent, educational up 0.3 percent, transportation up 1.3 percent; sewage and waste disposal up 0.5 percent; and water supply up 0.4 percent.

There were 288,000 job openings in construction, seasonally adjusted, at the end of September, a decrease of 134,000 (-32 percent) y/y, BLS reported. Hires for the full month totaled 336,000, an increase of 28,000 (9 percent). Layoffs totaled 178,000, a rise of 19,000 (12 percent) y/y, though the layoff rate (2.1 percent of employees) remained relatively low.

Construction employment, not seasonally adjusted, rose y/y from in September in 227 (63 percent) of the 358 metro areas (including divisions of larger metros) for which BLS posts construction employment data, fell in 63 (18 percent), and was unchanged in 68, according to an analysis AGC released. For most metros, BLS posts only combined totals for mining, logging, and construction; AGC treats these totals as construction-only.

The largest job gain again occurred in Houston-The Woodlands-Sugar Land (16,600 construction jobs, 7 percent), followed by Northern Virginia (8,300 combined jobs, 10 percent) and Las Vegas-Henderson-Paradise (6,700 construction jobs, 8 percent). Anchorage, Ala., had the largest percentage gain (17 percent, 2,100 construction jobs), followed by Honolulu (16 percent, 4,400 combined jobs) and Kahului-Wailuku-Lahaina, Hawaii (15 percent, 700 combined jobs). New York City again had the largest job loss (-8,800 combined jobs, -6 percent), followed by Portland-Vancouver-Hillsboro, Ore.-Wash. (-4,000 combined jobs, -5 percent). The largest percentage decrease occurred in Bloomington, Ill. (-13 percent, -500 combined jobs).