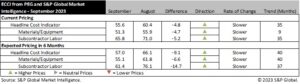

Engineering and construction costs increased again in September, according to the Engineering and Construction Cost Indicator from PEG and S&P Global Market Intelligence. The headline Engineering and Construction Cost Indicator—a leading indicator measuring wage and material inflation for the engineering, procurement, and construction sector—stepped down to 55.6 in September from 60.4 in August, indicating price increases were slightly less widespread than August. Price pressures eased for materials and equipment costs with the sub-indicator falling to 51.3 this month from 55.9 in August, the weakest reading since December. The sub-indicator for subcontractor labor costs decreased modestly to 65.8 in September, down from 71 in August.

The equipment and materials indicator continued to show rising prices, though only five of the 12 sub-indicators were above 50 in September. The categories for carbon steel pipe, alloy steel pipe, shell and tube heat exchangers, and fabricated structural steel were in contractionary territory in September, with values between 21.4 and 42.9. Copper-based wire and cable, pumps and compressors, and gas/steam turbines remained neutral with a value of 50. Readings for transformers, electrical equipment, and ready-mix concrete remained firmly in expansionary territory again this month. Meanwhile, global trade categories reported rising prices in September for the first time in over a year for ocean freight prices on Europe-to-U.S. and Asia-to-U.S. routes, each reporting values of 64.3.

“Transpacific carriers are beginning to reduce capacity by exercising more blank sailings and slow steaming in order to create upticks in spot pricing,” says Keyla Martinez, economist at S&P Global Market Intelligence. “This has materialized in higher spot rates for August and into September, but overall spot rates will remain far below 2022 and 2021 level highs as the recent uptick is minor compared to the larger recent downward correction.”

The sub-indicator for current subcontractor labor costs decreased in September, registering 65.8 after a 71 reading in August, indicating price increases were less widespread in September. Labor markets are not nearly as tight as they were in 2022; however, availability of construction workers remains tight. According to survey responses, labor cost escalation is most widespread in the U.S. Midwest and South and weakest in Canada and the U.S. Northeast.

The six-month headline expectations for future construction costs indicator decreased by 9.1 points to a reading of 57 in September. The six-month expectations indicator for materials and equipment came in at 55.1, 6.6 points lower than last month’s figure. The outlook for fabricated structural steel joined carbon steel pipe and alloy steel pipe in contractionary territory this month, while expectations for shell and tube heat exchangers, copper-based wire and cable, pumps and compressors, and the ocean freight categories all slowed to neutral. Prices are expected to increase over the next six months for ready-mix concrete, transformers, electrical equipment, and gas/steam turbines, but all registered lower readings by at least 10 points in September compared to the August survey.

The six-month expectations indicator for subcontractor labor decreased compared to August, down 14.7 points to a reading of 61.4. Decreases occurred in every category and region of the U.S., but results were mixed in Canada. Eastern Canada remains in primarily neutral territory at 50 and was joined there by some categories in Western Canada and the U.S. West and Northeast. The U.S. South remains the tightest market, with the Midwest expecting widespread price increases over the coming six months as well.

Respondents reported no specific material shortages in September and noted that the market is stable right now.