Very few parts of our lives have not been affected by the COVID-19 pandemic. This special report looks at the effect this pandemic has had on the construction industry and what we can expect the future to look like.

How the COVID-19 pandemic changed the construction industry

We’ve broken our reporting into three segments. Following is a report on the post-pandemic survey that polled industry participants on:

- How changed work-from-home policies affected their companies and may affect the industry.

- How remote learning policies may affect construction in the education segment.

- Which market segments will see growth and which will see a decline.

- Long-term changes to safety procedures, acceptance of wellness design and contract issues.

Our report digs in deeper with a feature article on how contractors and architects adapted to the pandemic and what they expect they will carry forward in their own businesses. (www.metalconstructionnews.com/coronavirus-survey)

The reaction to the pandemic was all about safety. The driving force was to protect all of us from its spread, so our third feature takes a look at how contractors dealt with the safety issue, including what they expect will carry forward in their own businesses. (Continuing Safely)

What’s driving the change going forward? According to a Pew Research Center poll conducted in October 2020, 20% of employed adults worked from home before the pandemic. That shot up to 71% during the pandemic, and 54% reported wanting to work from home after the pandemic ends.

To accomplish that, the country underwent a very rapid and significant adoption of technologies that allowed us to work from home and learn remotely. It also was a real-life experiment in our ability to manage our business and teach our children remotely.

In the post-pandemic survey our central questions were, “Will we as a country continue to embrace working from home and learning remotely?” and “How will or won’t that change in lifestyle affect the metal construction industry?” Our goal in this survey was to see how those work-from-home attitudes as well as remote learning innovations will affect the construction industry.

Last spring and summer, just after shelter-in-place requirements went countrywide, we ran three surveys to look at what was happening. The third survey, conducted the week of May 11, one and a half months after the first survey, showed that attitudes had already changed quickly about the pandemic. There was less concern about the COVID-19 virus and continued concern about the business climate among contractors, architects and suppliers. Compared to architects or suppliers, though, contractors were slightly more optimistic about the business environment. (You can see the surveys at www.metalconstructionnews.com/…)

In our current survey, you can see vestiges of that decrease in concern about the virus, and many of the respondents reported not only fatigue with the situation, but genuine disgruntlement about the handling of the virus. A number believe it has all been a hoax perpetrated for political gain.

The survey was conducted during June 2021 and had 362 responses.

Respondent Profiles

Most of the respondents to our survey were contractors, reporting they were a general contractor, metal building contractor, metal building erector, roofing contractor, metal roofing contractor or other kind of contractor. That group totaled about 49.2% of the overall respondents.

Architects and engineers represented 12.2% and manufacturers/suppliers accounted for 26.8%. A fair number of respondents identified themselves as fitting the other category (11.9%), and were predominantly consultants and other supporters of the industry.

Contractors and architects who responded worked in the whole gamut of market segments, with 81.8% of architects working on office buildings, which was the largest segment. More than 50% worked in educational, residential and retail segments. The office building segment was also a common arena for contractors to work in at 67.4%, but industrial (73.6%) and warehouse and self storage (68.5%) ranked higher.

Surprisingly, both a majority of architects (57.1%) and contractors (52.6%) reported that annual revenues increased from 2019 to 2020 in spite of the pandemic, showing the resiliency of the industry itself. More architects reported larger losses than contractors and more architects also reported larger gains year over year.

Work from Home Attitudes

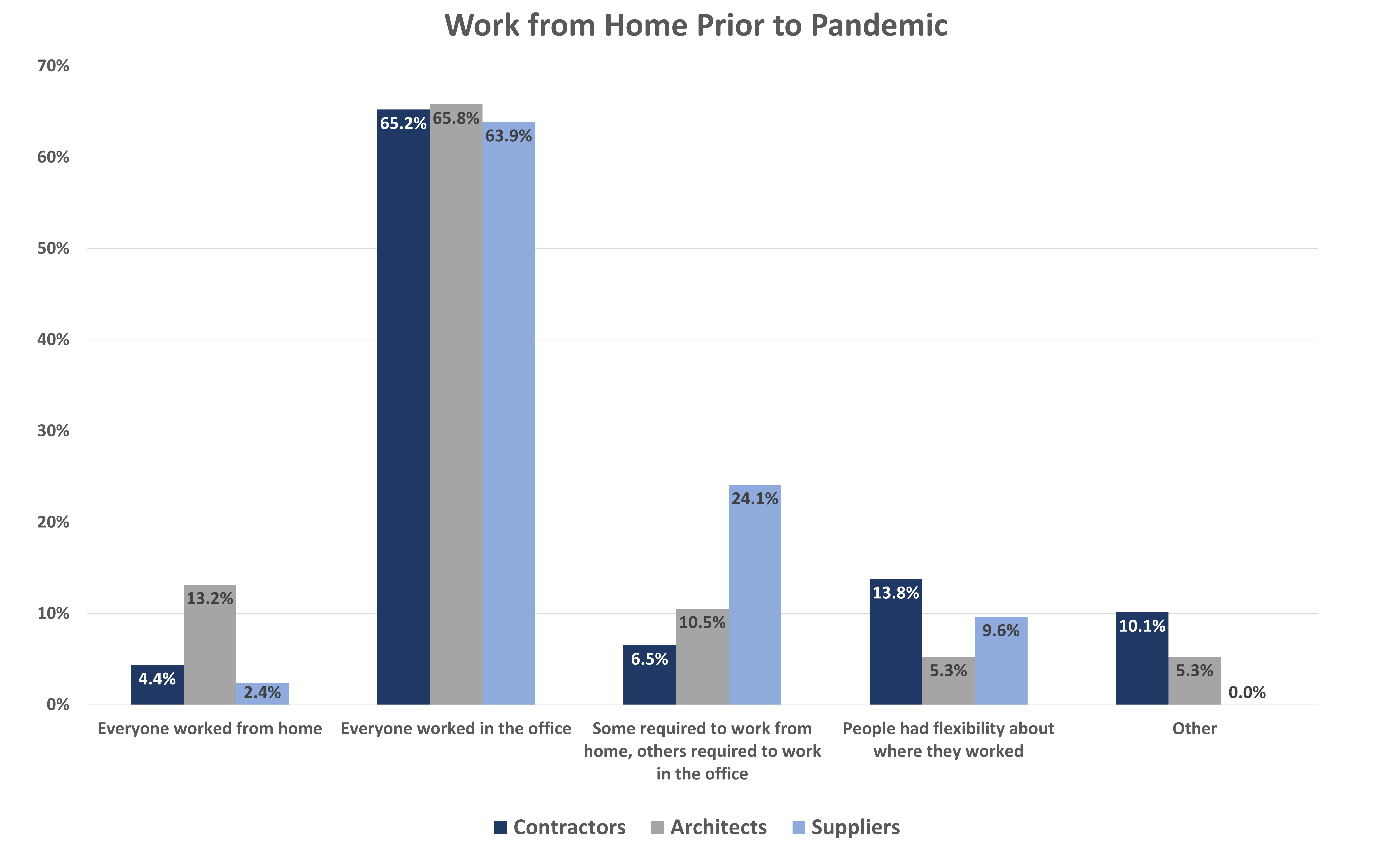

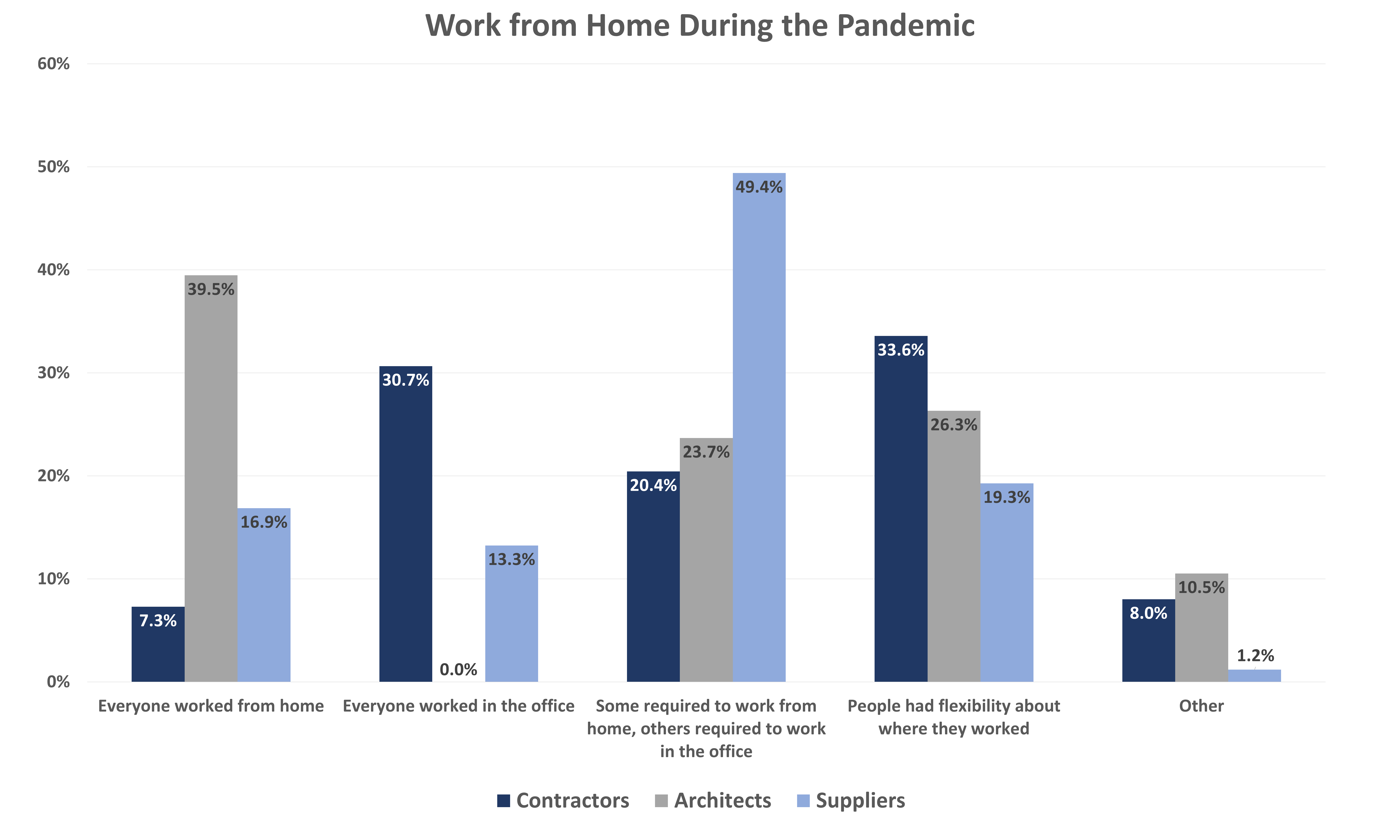

Charts 5 through 7 show attitudes of contractors, architects and suppliers about working from home within their companies before, during and after the pandemic. Before the pandemic, attitudes about working from home were closely aligned across all three groups, with the vast majority of them (all about 65%) having everyone in the company working in the office. Suppliers were more likely to require people work outside the office. You can probably assume that refers to an outside salesforce, which usually works out of home bases rather than a central office to give suppliers a wider and more efficient sales force.

That changed dramatically during the pandemic, of course, as shelter-in-place requirements were put in place. The shift to work-from-home policies, whether required of through flexibility, varied greatly across the three groups. Architects were more aggressive about sending people home and requiring them to stay there at 39.5%, but suppliers needed people on the shop floor, so office people were likely working from home while plant workers needed to be on the floor, keeping the operation running. Among architects, no respondents reported everyone worked in the office.

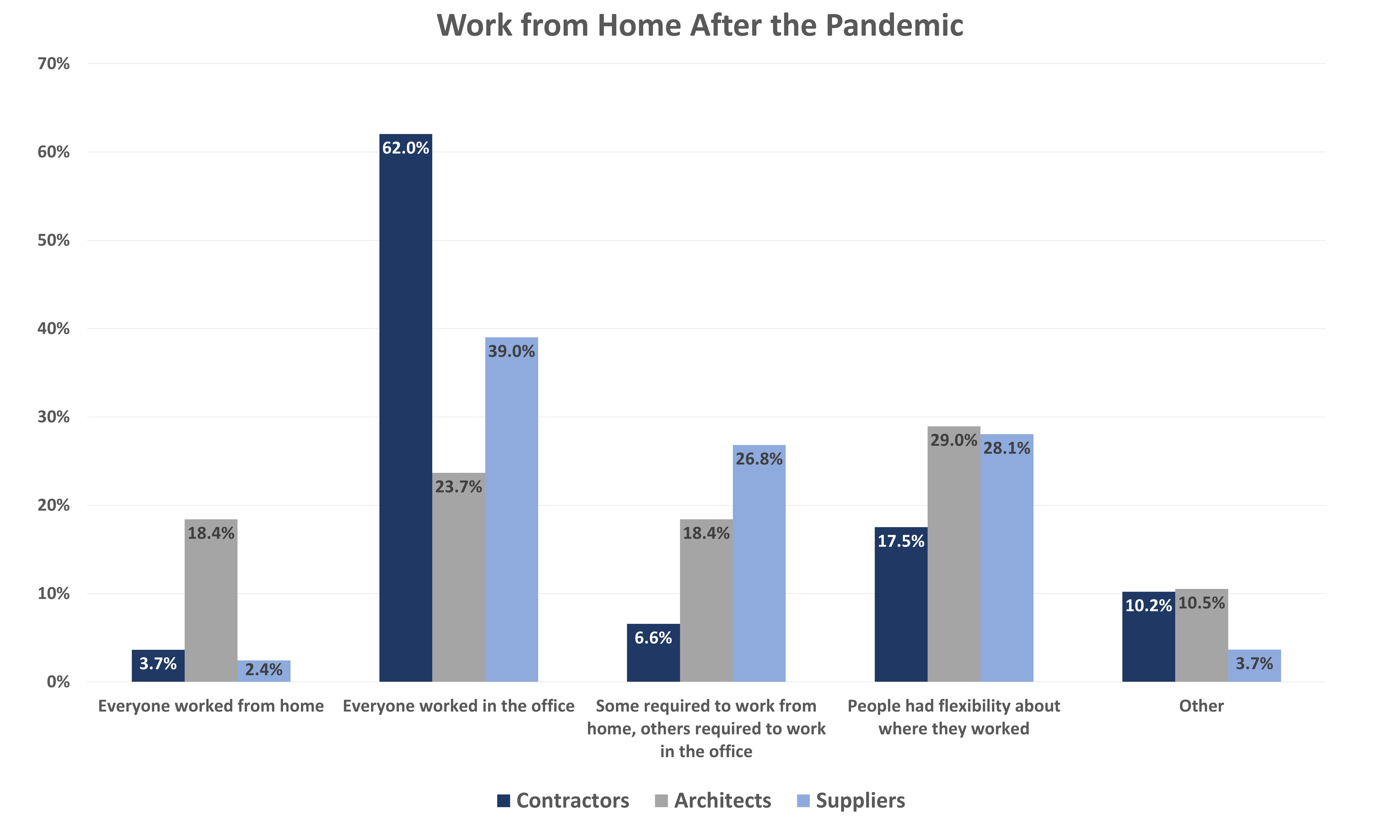

After the pandemic, work-from-home attitudes did not return to pre-pandemic levels. Comparing charts 5 and 7, you can see a distinct shift to more work-from-home opportunities.

Work-from-Home Change in Policy

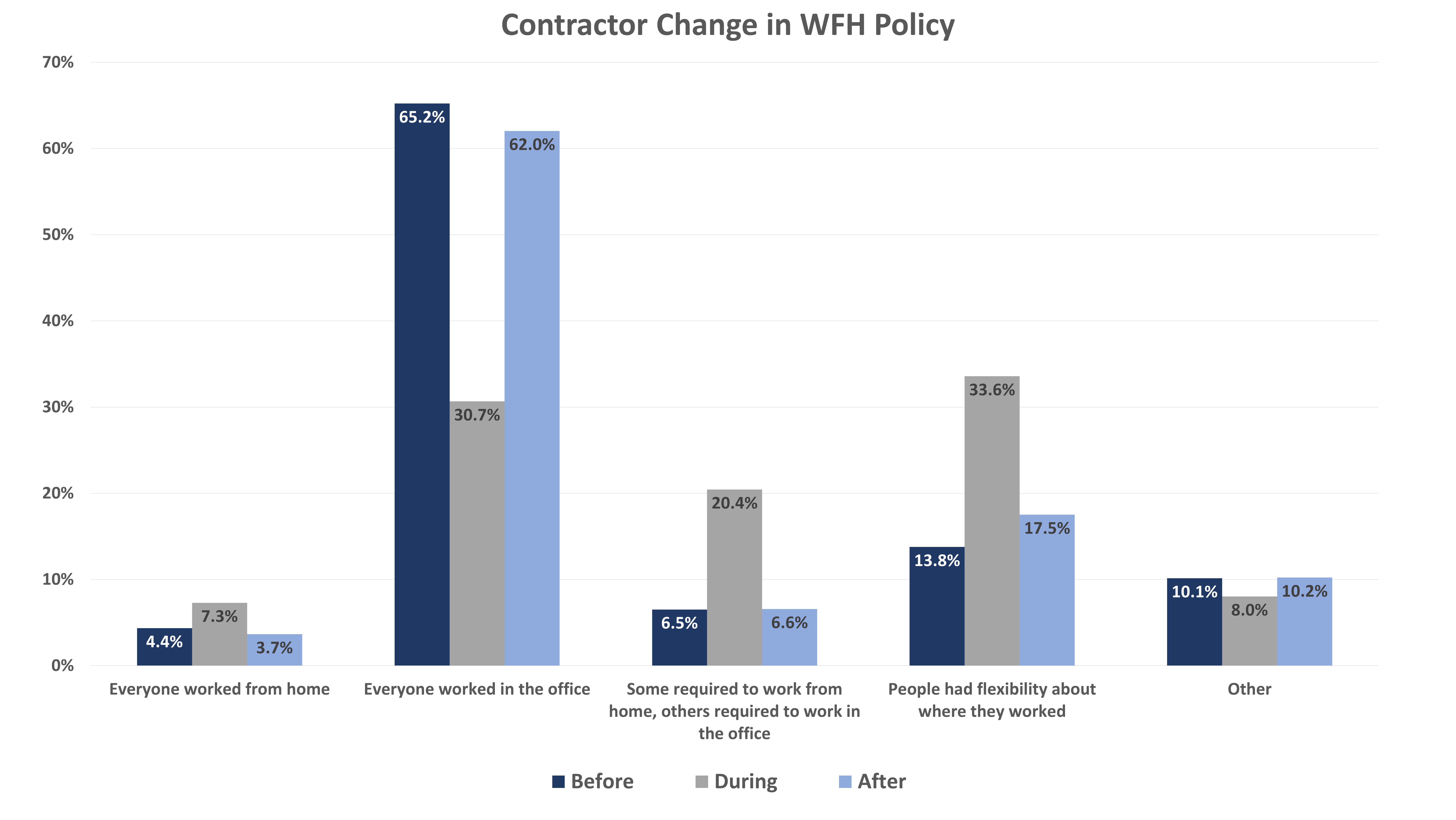

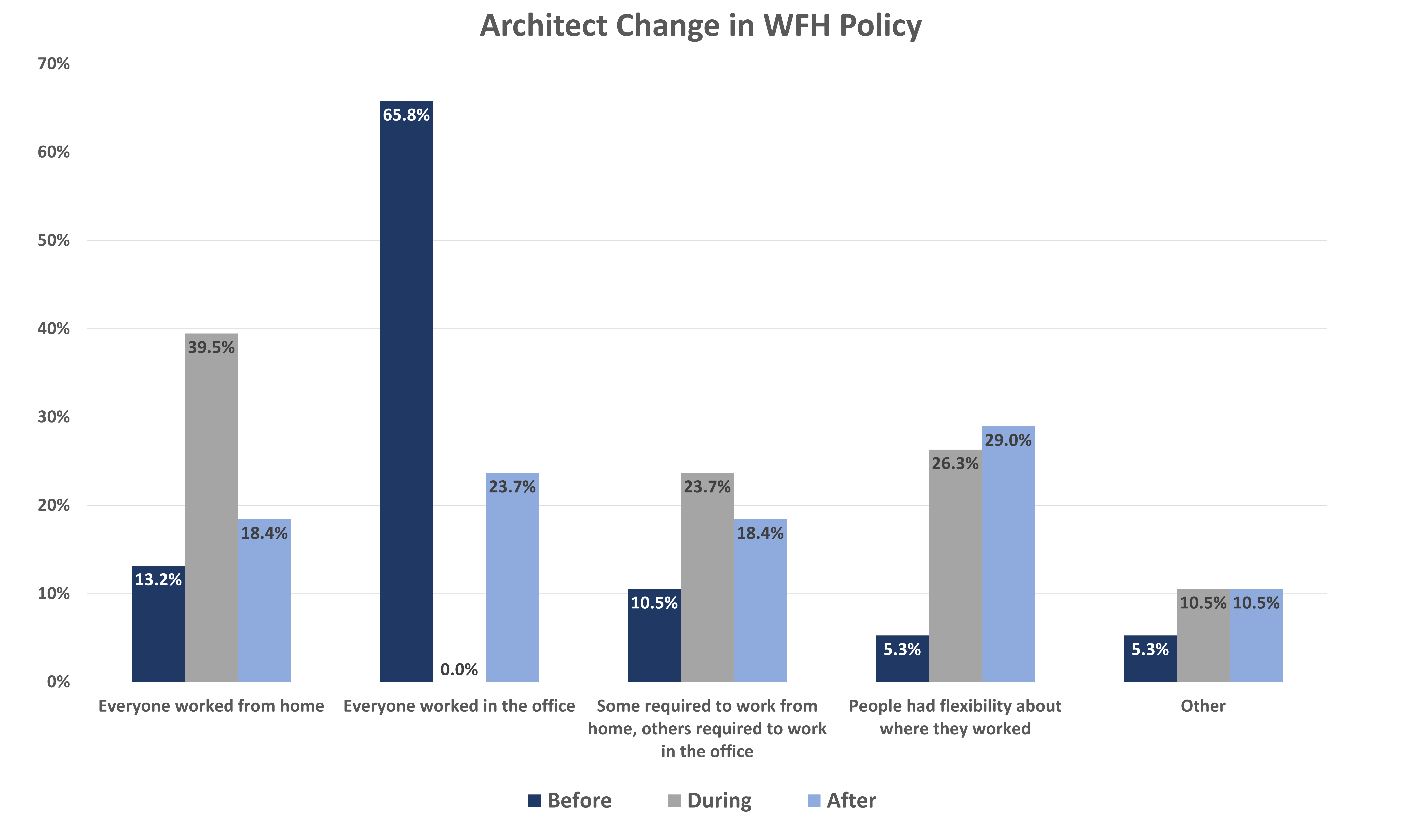

Charts 8 and 9 show the change in attitudes toward work-from-home policies among contractors and architects. Dark blue bars represent the before attitudes, gray the during attitudes and policies, and light blue show how contractors and architects resolved work-from-home issues after the pandemic.

Among contractors, it’s clear that most (more than 60%) of contractors returned to the requirement that everyone be in the office as soon as the pandemic was over. In fact, across all five options, contractors almost universally went back to the way things were.

The work-from-home policies among architects, though, shifted significantly. Before the pandemic, 65.8% of architects required everyone to work in the office, but after the pandemic, only 23.7% held to that policy. The shift was clearly to more people working from home whether by requirement or flexibility.

Work from Home and Remote Learning Changes to the Industry

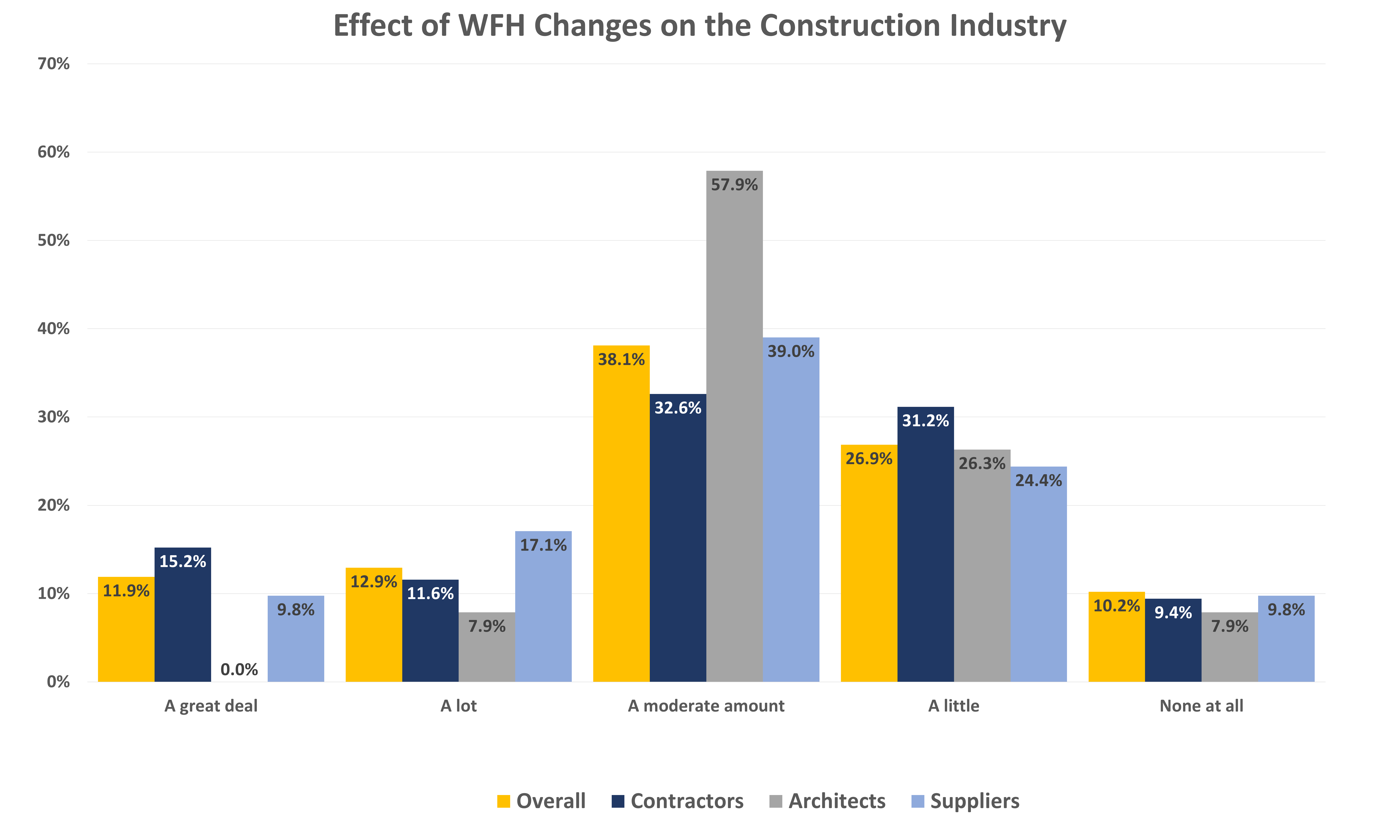

Recognizing that other industries were making the same business decisions as the construction industry about work-from-home policies, we wondered whether there would be an overall effect on the construction industry. If everyone is working from home, will there be less office building construction? Chart 10 shows survey taker’s responses to that question, and it presents as a classic bell curve with the greater number suggesting a moderate change (38.1% overall), while far fewer say either a great deal (11.9%) or none at all (10.2%).

Among contractors, architects and suppliers, the only group that stood out was architects. None of them thought the work-from-home changes would affect the industry a great deal and the majority (57.9%) believed the effect would be moderate.

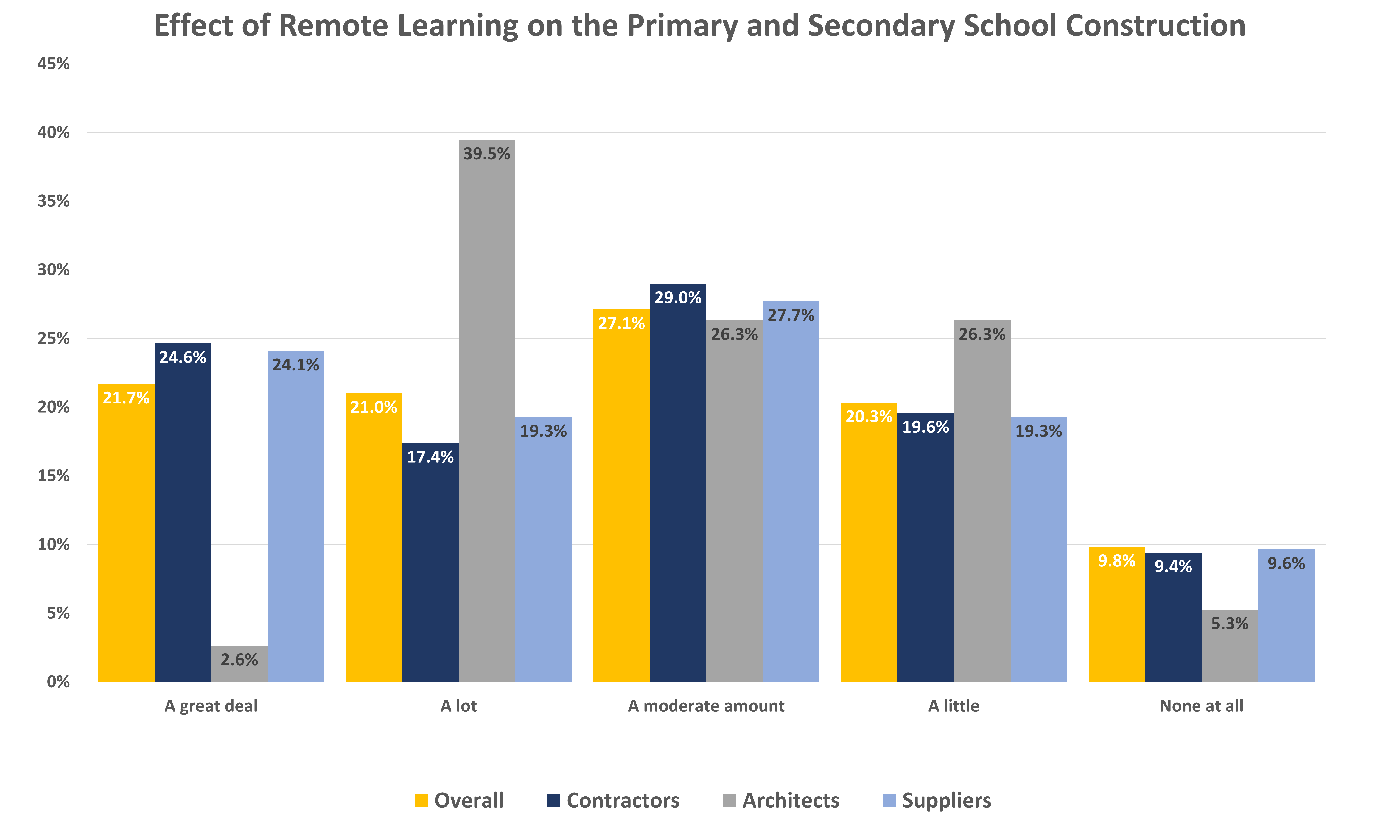

Working from home wasn’t the only big change in our society during the pandemic. We also pulled the kids out of school and enacted a huge experiment on remote learning. In a similar way to work-from-home policies, increased remote learning policies could affect the construction industry. With fewer students in the classroom or living on campus, what would be the resulting change in infrastructure needs?

We divided this question into attitudes about primary and secondary schools versus colleges and universities. Interestingly, more respondents (21.7%) thought the pandemic would have a great deal of influence on primary and secondary school construction, while very few architects (2.6%) felt that. But that’s not to say architects felt there would be no effect. In fact, 39.5% said the effect would be “a lot.”

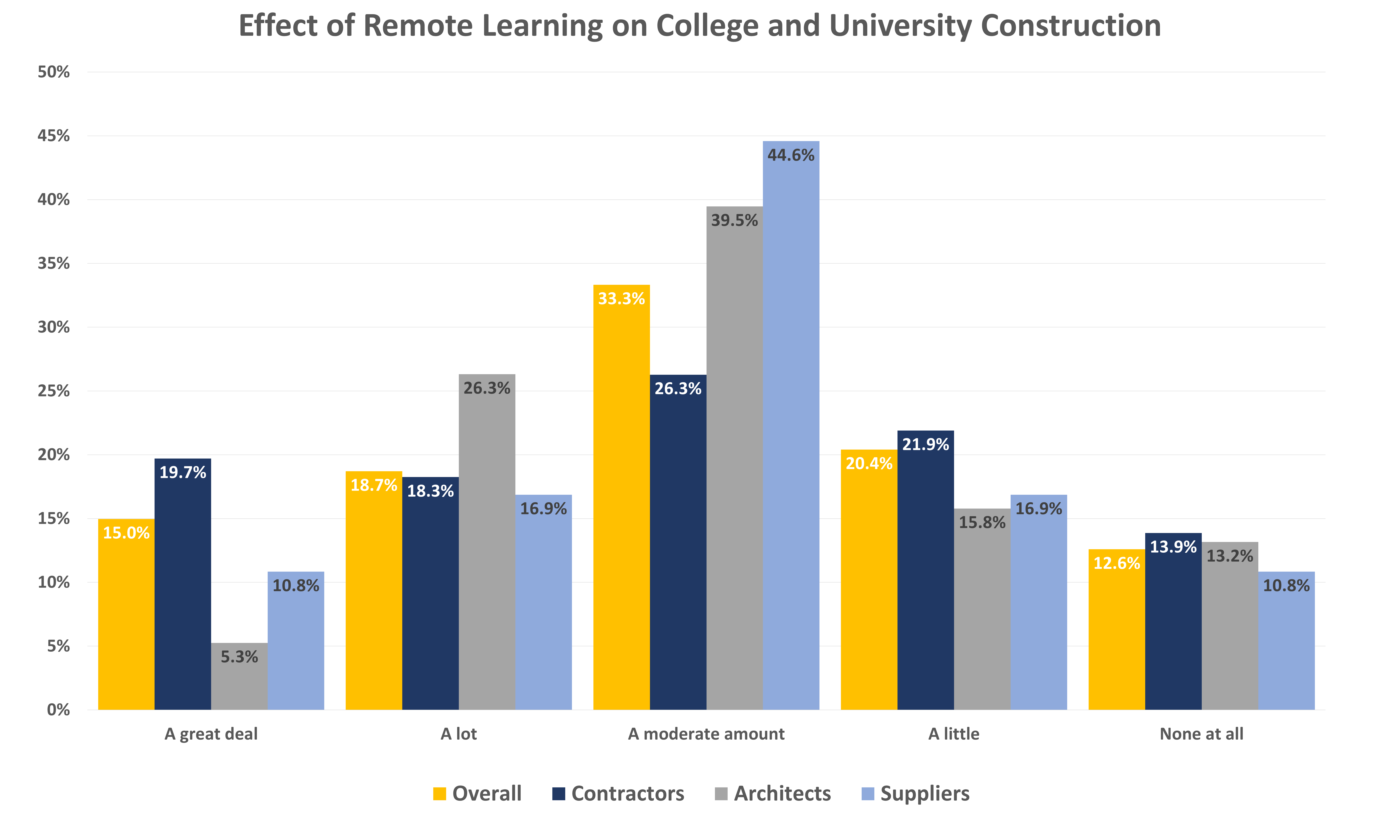

Looking at college and university construction, respondents were not nearly as robust in their beliefs that any potential changes in policy regarding remote learning would have an effect on construction. We totaled the overall scores for respondents who thought there would be an effect (a great deal, a lot or a moderate amount) as a result of work-from-home changes and remote learning changes. 62.9% of respondents thought work-from-home changes would have an effect on the construction industry; 69.8% thought remote learning would have an effect on the primary and secondary school segment; and 67% thought remote learning would have an effect on college and university construction.

Overall Effect of the Pandemic

The big question is how would the pandemic affect the construction industry overall. We asked, “All things being equal, how will the pandemic affect the size of the overall construction market?” The question is purposely broad to get a sense of respondents’ high-level feelings about the effect of the pandemic.

There is no clear majority answer. Among all respondents, 42.1% thought the pandemic would have no long-lasting influence, 26.7% thought it would make the market larger and 31.2% thought it would be smaller. Even breaking responses out by type of company, there was considerable similarity in response. The one notable exception is that contractors were more likely to think the market would be smaller than either architects or suppliers.

We asked in previous questions specifically about the education segment, but we also wanted to get a sense of where the winners and losers would be across all segments. What market segments would increase or decline over the next five years, influenced by the pandemic? Chart 14 shows three big winners and two big losers. Most respondents thought health care, residential and warehouses and storage would see increases in the next five years. (See red arrows.)

The two segments the most respondents thought would see declines are office buildings and retail. (See green arrows.) As retail declines, it follows that warehouse and storage would necessarily increase to accommodate more online shopping. Office building construction declines can be traced to increased work-from-home rates, as we’ve already discussed. We would suggest that residential and health care increases are as much a part of a general trend in those directions as they are a result of the pandemic, but there’s insufficient data to draw a clear conclusion.

Safety

Contractors and suppliers did amazing things to keep the engines of the construction industry working while protecting workers from the COVID-19 virus. We were curious what safety protocols would carry over long term after the pandemic was ended.

The only protocol that contractors thought would have legs on the job site was hand washing and other hygienic procedures with 56.2% of respondents saying they would likely continue. But over 40% of respondents said none of the pandemic safety protocols would continue.

On the shop floor, the story is the same, although more supplier respondents thought hand washing would continue (65.9%) than contractors did. That translates into fewer saying no protocols would continue on the shop floor.

Technology

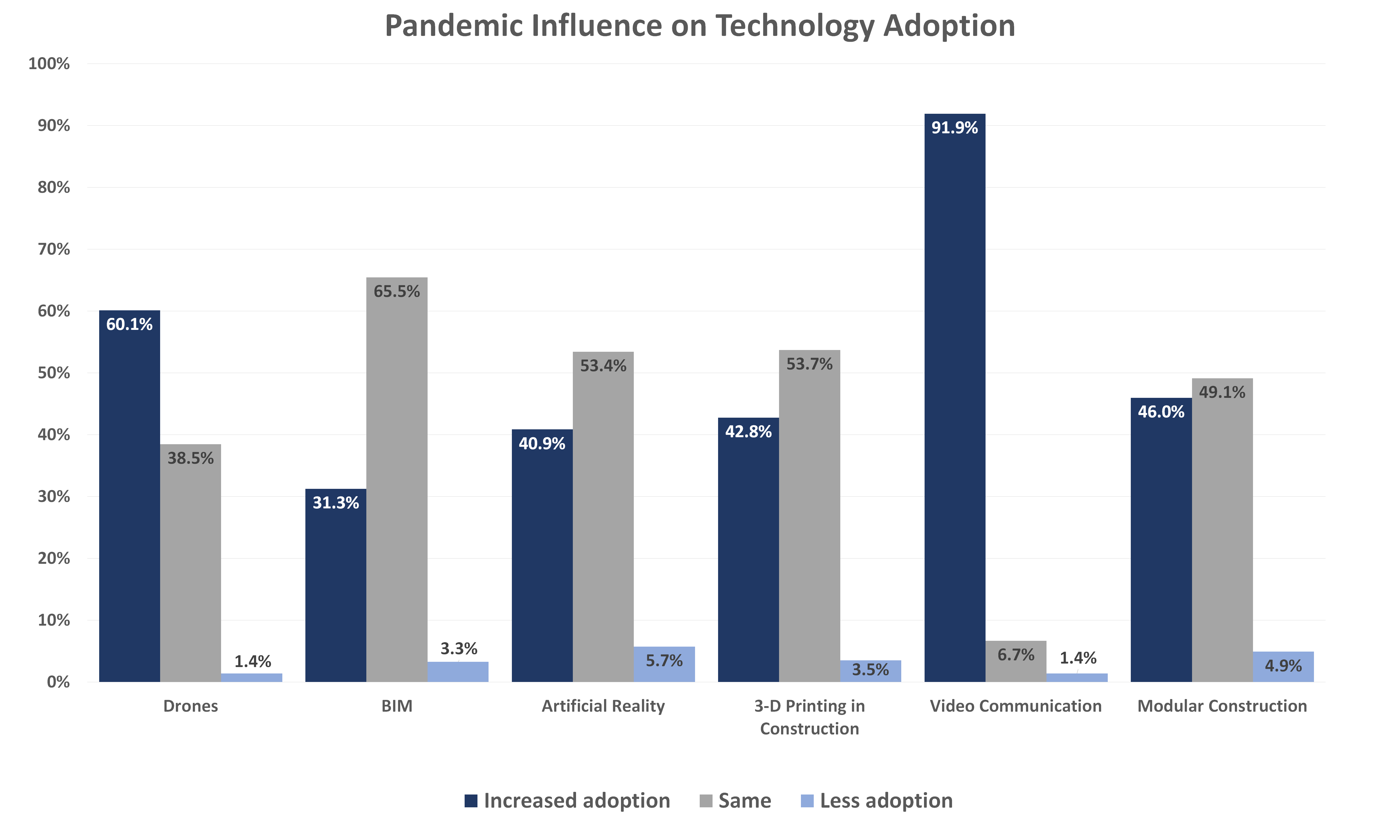

Without video communication, the economic decline in spring and summer 2020 would probably have been even worse as businesses would have had even greater struggles to keep producing products and providing services. It’s not surprise that 91.9% of respondents felt the pandemic would have an influence on the adoption of video communication technology.

Across all the technologies we asked about, there was almost no agreement that the adoption of any of them would decline as a result of the pandemic, but respondents (60.1%) were more likely to point to drone usage increasing than other technologies. In fact, it was the only technology where a majority of respondents felt there would be increased adoption as a result of the pandemic.

Wellness

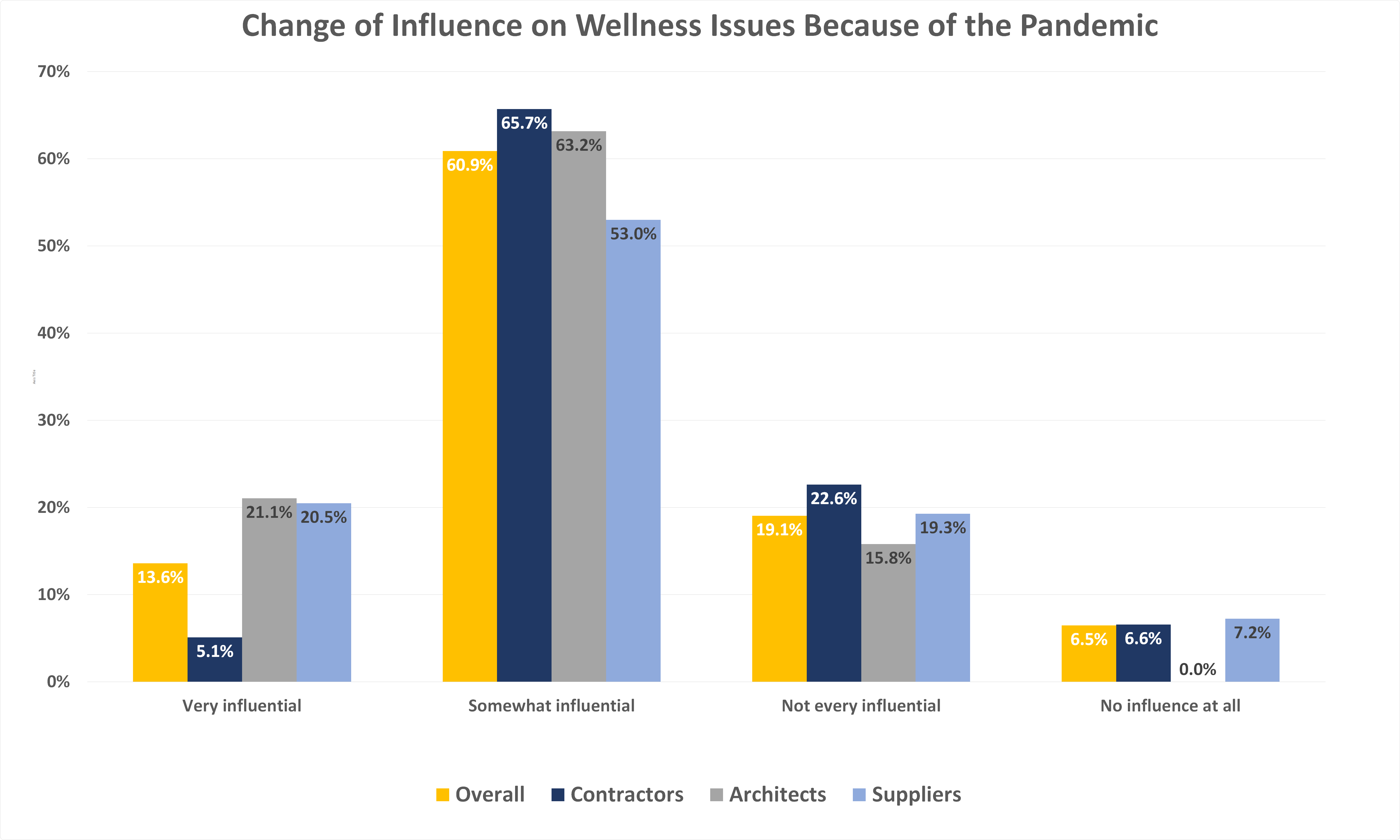

The wellness movement isn’t new, but the focus on clean and healthy environments took a leap ahead during the pandemic. Our respondents report that the pandemic will be somewhat influential (60.9% of overall respondents) and that attitude generally held true across contractors (65.7%), architects (63.2%) and suppliers (53%). Only 13.6% of respondents thought the pandemic would have a large influence on the wellness movement.

Legal

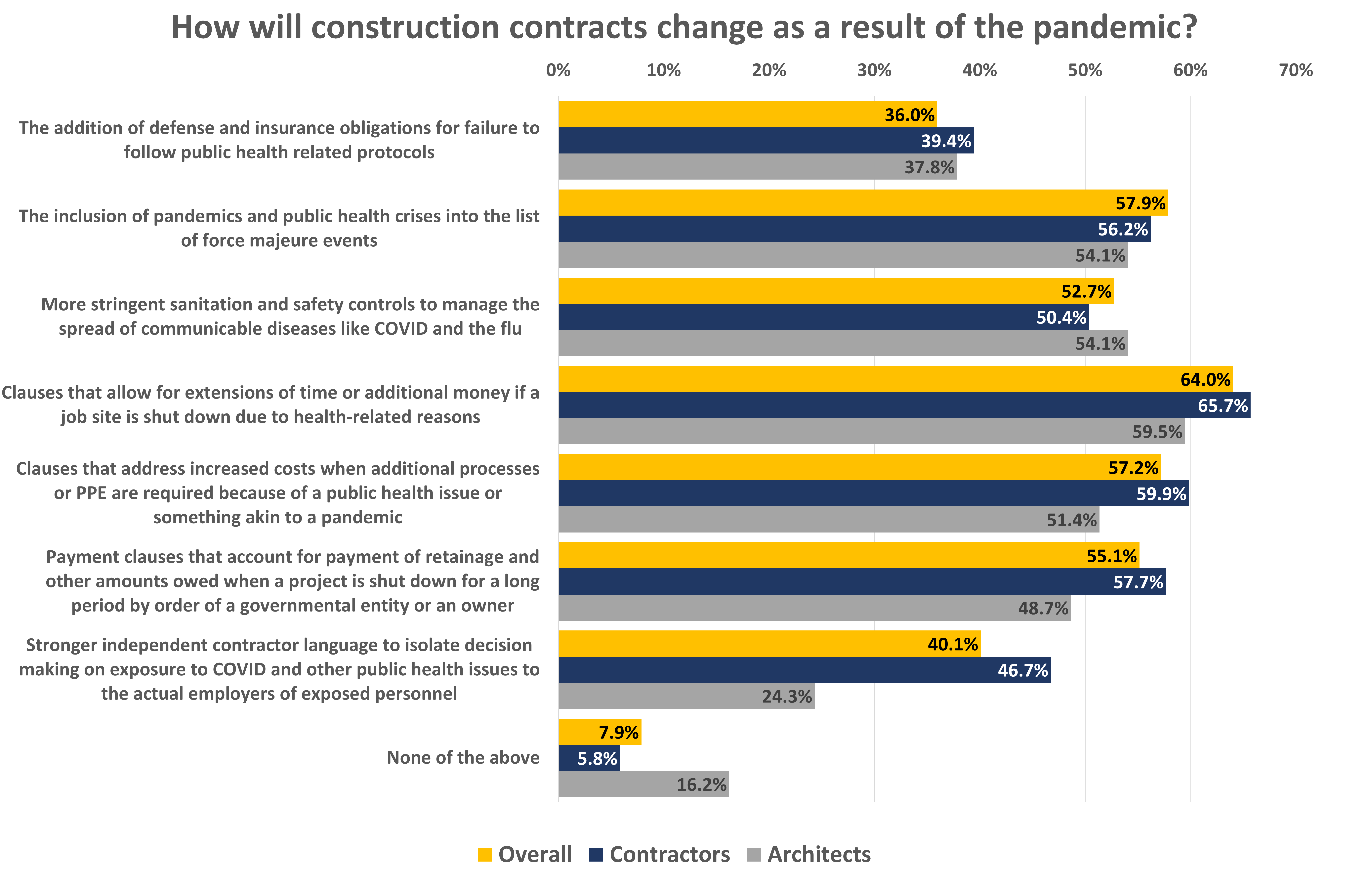

We’ve saved what is clearly the most confusing chart until the end. We were curious about how the pandemic may affect construction contracts. Our law columnist, Joshua Quinter, principal attorney at Offit Kurman, Plymouth Meeting, Pa., suggested several potential clauses that may be added to contracts as a result of the pandemic, and we queried our respondents about them. (Please note, Quinter does not suggest these should be included, only that is possible you may see them.)

For the most part, a majority of respondents thought that most of these clauses could be included, and there was very little difference between contractors and architects on the likelihood of that happening. Very few respondents (7.9%) thought that none of the clauses would be included.